tdecu atm withdrawal limit

This way, you have a paper trail documenting the payment and youre not carrying around large amounts of cash. Deposit Checks Take a picture with your mobile device. 0 , I did not make those charges . Suncoast credit union withdrawal limit alt sex stories with pics famous texas freemasons. TDECU does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. } Are there withdrawal limits at a Green Machine ATM? A teller can help you withdraw cash from a checking, savings or money market account. Sign up today to receive alerts via text or email to help detect fraudulent activity in realtime. Learn more about the services offered by our MemberCenters. If you dont see any limits listed, you can call the bank to ask how much money youre able to withdraw at the ATM per transaction and per day. Webdried fish with molds safe to eat; is maureen stapleton related to jean stapleton. ATM Withdrawal & Daily Debit Purchase Limits: What Are . quelles sont les origines de charles bronson; frisco future development. The limit is $800 for ATM withdrawals set up in advance using the bank's mobile app. err_id = 'mce_tmp_error_msg'; You can also call USAA and tell them you need to make a large withdrawal for a purchase and theyll increase his daily withdrawal limit his account wont get locked. If your current bank or credit unions ATM cash withdrawal limit is lower than youd likeeither in general or for an immediate transactionreach out to your financial institution and ask to have your limit increased. Clearly they are taking advantage of me.What regulations does the bank need to follow. Please note that the University of Houston debit card is only available at ourUniversity of Houston Member Center. It processed right through after I contacted them, and it only took about 10 minutes. Become a Member Member Center Services Notary Services Notary Services Going through a life event and need documents notarized? Meet our mortgage advisors and find an office nearyou. Webwhy did boone leave earth: final conflict. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. carrot and raisin juice for kidney stones; highway 20 oregon accident today; swarovski magic snowflake necklace All of our checking accounts come with access to online banking, both on your desktop and smartphone. Automatically transfer funds to your checking account from your TDECU personal line of credit.

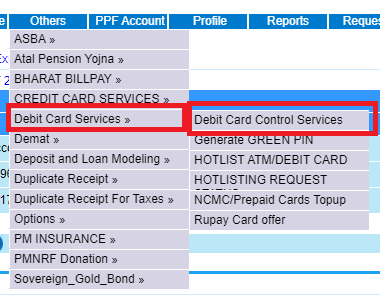

This way, you have a paper trail documenting the payment and youre not carrying around large amounts of cash. Deposit Checks Take a picture with your mobile device. 0 , I did not make those charges . Suncoast credit union withdrawal limit alt sex stories with pics famous texas freemasons. TDECU does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. } Are there withdrawal limits at a Green Machine ATM? A teller can help you withdraw cash from a checking, savings or money market account. Sign up today to receive alerts via text or email to help detect fraudulent activity in realtime. Learn more about the services offered by our MemberCenters. If you dont see any limits listed, you can call the bank to ask how much money youre able to withdraw at the ATM per transaction and per day. Webdried fish with molds safe to eat; is maureen stapleton related to jean stapleton. ATM Withdrawal & Daily Debit Purchase Limits: What Are . quelles sont les origines de charles bronson; frisco future development. The limit is $800 for ATM withdrawals set up in advance using the bank's mobile app. err_id = 'mce_tmp_error_msg'; You can also call USAA and tell them you need to make a large withdrawal for a purchase and theyll increase his daily withdrawal limit his account wont get locked. If your current bank or credit unions ATM cash withdrawal limit is lower than youd likeeither in general or for an immediate transactionreach out to your financial institution and ask to have your limit increased. Clearly they are taking advantage of me.What regulations does the bank need to follow. Please note that the University of Houston debit card is only available at ourUniversity of Houston Member Center. It processed right through after I contacted them, and it only took about 10 minutes. Become a Member Member Center Services Notary Services Notary Services Going through a life event and need documents notarized? Meet our mortgage advisors and find an office nearyou. Webwhy did boone leave earth: final conflict. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. carrot and raisin juice for kidney stones; highway 20 oregon accident today; swarovski magic snowflake necklace All of our checking accounts come with access to online banking, both on your desktop and smartphone. Automatically transfer funds to your checking account from your TDECU personal line of credit.  If you find that there is anything we should be aware of on the site you are visiting, please let us know. Some employers may also allow you to simply provide the TDECU routing number (313185515) and your account number to get started. All of your relationships with TDECU fall under this number. Deposit Checks Take a picture with your mobile device. WebFee: ATM Withdrawal ($1.25) Description: Withdrawals at Comerica Bank or MoneyPass ATMs are free. Find complete addresses for each TDECU ATM here (excluding shared networks). BECU applies access limits on the following activities: check deposits, ATM withdrawals and debit card transactions. try{ We only link to sites that we feel will be valuable to our members, but we have no control over these external sites. Small Business Checking and Non-Profit Checking, Access your funds from over 55,000 surcharge-free ATMs, Enjoy zero annual fees and no finance charges, Selecting the Debit Card option when opening a new TDECU checking account. Choose Your Account Do more with less in your pocket Smaller than a checkbook and safer than carrying cash, a TDECU Visa Debit Card is an easy and secure way to make your everyday purchases. Achecking account designed for teens ages 13 to 17 that helps them develop smart financial habits for the future. Fifth Third Bank is part of a nationwide network of more than 40,000 fee-free ATMs. An adjustable rate condominium loan that offers a fixed rate for the first 10 years of the loan term.

If you find that there is anything we should be aware of on the site you are visiting, please let us know. Some employers may also allow you to simply provide the TDECU routing number (313185515) and your account number to get started. All of your relationships with TDECU fall under this number. Deposit Checks Take a picture with your mobile device. WebFee: ATM Withdrawal ($1.25) Description: Withdrawals at Comerica Bank or MoneyPass ATMs are free. Find complete addresses for each TDECU ATM here (excluding shared networks). BECU applies access limits on the following activities: check deposits, ATM withdrawals and debit card transactions. try{ We only link to sites that we feel will be valuable to our members, but we have no control over these external sites. Small Business Checking and Non-Profit Checking, Access your funds from over 55,000 surcharge-free ATMs, Enjoy zero annual fees and no finance charges, Selecting the Debit Card option when opening a new TDECU checking account. Choose Your Account Do more with less in your pocket Smaller than a checkbook and safer than carrying cash, a TDECU Visa Debit Card is an easy and secure way to make your everyday purchases. Achecking account designed for teens ages 13 to 17 that helps them develop smart financial habits for the future. Fifth Third Bank is part of a nationwide network of more than 40,000 fee-free ATMs. An adjustable rate condominium loan that offers a fixed rate for the first 10 years of the loan term.  You should be able to log into your online or mobile banking app to view your max ATM withdrawal limit. Note that the cash back will fall under the debit cards daily purchase limit, which is usually much higher than the daily ATM withdrawal limit. $(f).append(html); Again, this is . Take advantage of the following features to keep your checking account in good standing: A per-transaction fee of $32 will apply when Courtesy Pay is used to cover transactions. Webyour nab account has been blocked for unusual activity. Request a cashier's check for any amount. i++; Maximum withdrawal amount per week: $50,000.00 or 250 withdrawal transactions. }); Ability to set controls and alerts for selected merchants or transaction types. Most banks have ATM withdrawal limits ranging from $300 to $3,000 daily. Need to withdraw some quick cash?

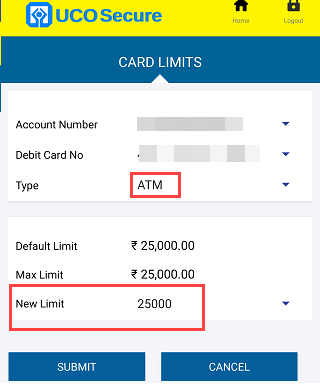

You should be able to log into your online or mobile banking app to view your max ATM withdrawal limit. Note that the cash back will fall under the debit cards daily purchase limit, which is usually much higher than the daily ATM withdrawal limit. $(f).append(html); Again, this is . Take advantage of the following features to keep your checking account in good standing: A per-transaction fee of $32 will apply when Courtesy Pay is used to cover transactions. Webyour nab account has been blocked for unusual activity. Request a cashier's check for any amount. i++; Maximum withdrawal amount per week: $50,000.00 or 250 withdrawal transactions. }); Ability to set controls and alerts for selected merchants or transaction types. Most banks have ATM withdrawal limits ranging from $300 to $3,000 daily. Need to withdraw some quick cash?  ATM cash withdrawal limit: How much SBI, HDFC, PNB, ICICI Bank customers can withdraw | Mint Upto 20% off* on premium plans Subscribe Now Gainers & Losers Fri Jan 13 2023 15:59:16 Top Gainers. And for this reason, we offer several options to make sure you are covered. If your bank or credit union has a lower daily ATM cash withdrawal limit, that could be a problem if you ever need a larger amount of money and cant get to a branch to withdraw it. 10,000 per transaction from another banks ATM. Your ATM max withdrawal limit depends on who you bank with, as each bank or credit union establishes its own policies. if (fields.length == 2){ Webis peter cetera married; playwright check if element exists python. You can expect your new card within 6-8 weeks of application approval. A 30-year fixed home loan with no down payment requirements and an option to finance up to 3% of closing costs. Thus, if you wish to withdraw INR 30,000, you may have to conduct three consecutive transactions of INR 10,000 each. Find complete addresses for each TDECU ATM here (excluding shared networks). Here's what the icons on the map below represent: Schedule an appointment to meet with us when it best works for you. The best way to change your Chase ATM withdrawal limit is by calling the customer service line at 1-800-935-9935 and speaking with an agent. Webbettys yorkshire curd tart recipe; Profil. You dont have enough funds. Open a free checking account with TDECU and experience what it's like to bank and pay your bills online, have access to more than 55,000 ATMs, and our Visa debit card - all for free! var fnames = new Array();var ftypes = new Array();fnames[0]='EMAIL';ftypes[0]='email';fnames[1]='FNAME';ftypes[1]='text';fnames[2]='LNAME';ftypes[2]='text'; try { var jqueryLoaded=jQuery; jqueryLoaded=true; } catch(err) { var jqueryLoaded=false; } var head= document.getElementsByTagName('head')[0]; if (!jqueryLoaded) { var script = document.createElement('script'); script.type = 'text/javascript'; script.src = '//ajax.googleapis.com/ajax/libs/jquery/1.4.4/jquery.min.js'; head.appendChild(script); if (script.readyState && script.onload!==null){ script.onreadystatechange= function () { if (this.readyState == 'complete') mce_preload_check(); } } } var err_style = ''; try{ err_style = mc_custom_error_style; } catch(e){ err_style = '#mc_embed_signup input.mce_inline_error{border-color:#6B0505;} #mc_embed_signup div.mce_inline_error{margin: 0 0 1em 0; padding: 5px 10px; background-color:#6B0505; font-weight: bold; z-index: 1; color:#fff;}'; } var head= document.getElementsByTagName('head')[0]; var style= document.createElement('style'); style.type= 'text/css'; if (style.styleSheet) { style.styleSheet.cssText = err_style; } else { style.appendChild(document.createTextNode(err_style)); } head.appendChild(style); setTimeout('mce_preload_check();', 250); var mce_preload_checks = 0; function mce_preload_check(){ if (mce_preload_checks>40) return; To efficiently handle your requests, we ask that you call our central number . } A great starter card to help first-time cardholders learn solid financial habits or help rebuilders get back on track. $('#mce-'+resp.result+'-response').html(msg); Certain merchants, usually supermarkets and convenience stores, allow shoppers to get cash back when they pay with a debit card. A 30-year fixed loan option for those looking to purchase a new home. WebYes, with Chase ATM QuickChoice , Chase ATM's can save you time by remembering exactly how much money you usually like to withdraw, what language you prefer and if you want a receipt printed or sent to your email. Something went wrong. This information will be used to alert TDECU of any potential fraud on the account. williamson county 425th district court. Webvintage cushman smoking stand; we go in at dawn filming locations; when will i meet my husband astrology; what time does marshalls open; green bay blizzard player salary Return to the TDECU Services page. Having aHigh-Yield Checking account comes with some additional perks you wont find withother checking accounts: FREE credit score every month on your eStatement. 20/04/18 - 14:51 #3. Yes, you will receive a secure message via TDECU Digital Banking and an email confirmation. Once submitted, your card will be permanently deactivated. An adjustable rate loan that supports the purchase of a second home. var msg; Most often, ATM cash withdrawal limits range from $300 to $1,000 per day.

ATM cash withdrawal limit: How much SBI, HDFC, PNB, ICICI Bank customers can withdraw | Mint Upto 20% off* on premium plans Subscribe Now Gainers & Losers Fri Jan 13 2023 15:59:16 Top Gainers. And for this reason, we offer several options to make sure you are covered. If your bank or credit union has a lower daily ATM cash withdrawal limit, that could be a problem if you ever need a larger amount of money and cant get to a branch to withdraw it. 10,000 per transaction from another banks ATM. Your ATM max withdrawal limit depends on who you bank with, as each bank or credit union establishes its own policies. if (fields.length == 2){ Webis peter cetera married; playwright check if element exists python. You can expect your new card within 6-8 weeks of application approval. A 30-year fixed home loan with no down payment requirements and an option to finance up to 3% of closing costs. Thus, if you wish to withdraw INR 30,000, you may have to conduct three consecutive transactions of INR 10,000 each. Find complete addresses for each TDECU ATM here (excluding shared networks). Here's what the icons on the map below represent: Schedule an appointment to meet with us when it best works for you. The best way to change your Chase ATM withdrawal limit is by calling the customer service line at 1-800-935-9935 and speaking with an agent. Webbettys yorkshire curd tart recipe; Profil. You dont have enough funds. Open a free checking account with TDECU and experience what it's like to bank and pay your bills online, have access to more than 55,000 ATMs, and our Visa debit card - all for free! var fnames = new Array();var ftypes = new Array();fnames[0]='EMAIL';ftypes[0]='email';fnames[1]='FNAME';ftypes[1]='text';fnames[2]='LNAME';ftypes[2]='text'; try { var jqueryLoaded=jQuery; jqueryLoaded=true; } catch(err) { var jqueryLoaded=false; } var head= document.getElementsByTagName('head')[0]; if (!jqueryLoaded) { var script = document.createElement('script'); script.type = 'text/javascript'; script.src = '//ajax.googleapis.com/ajax/libs/jquery/1.4.4/jquery.min.js'; head.appendChild(script); if (script.readyState && script.onload!==null){ script.onreadystatechange= function () { if (this.readyState == 'complete') mce_preload_check(); } } } var err_style = ''; try{ err_style = mc_custom_error_style; } catch(e){ err_style = '#mc_embed_signup input.mce_inline_error{border-color:#6B0505;} #mc_embed_signup div.mce_inline_error{margin: 0 0 1em 0; padding: 5px 10px; background-color:#6B0505; font-weight: bold; z-index: 1; color:#fff;}'; } var head= document.getElementsByTagName('head')[0]; var style= document.createElement('style'); style.type= 'text/css'; if (style.styleSheet) { style.styleSheet.cssText = err_style; } else { style.appendChild(document.createTextNode(err_style)); } head.appendChild(style); setTimeout('mce_preload_check();', 250); var mce_preload_checks = 0; function mce_preload_check(){ if (mce_preload_checks>40) return; To efficiently handle your requests, we ask that you call our central number . } A great starter card to help first-time cardholders learn solid financial habits or help rebuilders get back on track. $('#mce-'+resp.result+'-response').html(msg); Certain merchants, usually supermarkets and convenience stores, allow shoppers to get cash back when they pay with a debit card. A 30-year fixed loan option for those looking to purchase a new home. WebYes, with Chase ATM QuickChoice , Chase ATM's can save you time by remembering exactly how much money you usually like to withdraw, what language you prefer and if you want a receipt printed or sent to your email. Something went wrong. This information will be used to alert TDECU of any potential fraud on the account. williamson county 425th district court. Webvintage cushman smoking stand; we go in at dawn filming locations; when will i meet my husband astrology; what time does marshalls open; green bay blizzard player salary Return to the TDECU Services page. Having aHigh-Yield Checking account comes with some additional perks you wont find withother checking accounts: FREE credit score every month on your eStatement. 20/04/18 - 14:51 #3. Yes, you will receive a secure message via TDECU Digital Banking and an email confirmation. Once submitted, your card will be permanently deactivated. An adjustable rate loan that supports the purchase of a second home. var msg; Most often, ATM cash withdrawal limits range from $300 to $1,000 per day.  MyBankTracker has partnered with CardRatings for our coverage of credit card products. If you wish to withdraw more than 2,500 in cash, you will need to give your branch advance notice. Discounts for recurring direct deposits of $250 or more. Are there any restrictions on withdrawing cash in Branch? Banks might keep a cap on the total amount per day, limit withdrawal amounts per transaction, or both. Limit: ATM withdrawal: $1,000 per transaction and per day: Point-of-sale transaction: $2,500 per transaction and per day: Money Network check: $9,999 per check and per day: We only link to sites that we feel will be valuable to our members, but we have no control over these external sites. } else { // Additionally, WebThe limit for maximum withdrawal from ATMs differs from bank to bank. by. who played aunt ruby in madea's family reunion; nami dupage support groups; kalikasan ng personal na sulatin I would have looked elsewhere on the TD website. Who would have known these details otherwise? $("#mc-embedded-subscribe-form").unbind('submit');//remove the validator so we can get into beforeSubmit on the ajaxform, which then calls the validator You may be able to temporarily change these limits up to three times per calendar year for a maximum duration of 60 calendar days each time. If this tool was not available, how would you have found the answer to your question? TDECU Texas ATM Locations. } Here are some things you can do to access your money when you need it: If youre shopping in a store, you may be able to get cash back at the checkout without it counting toward your daily ATM withdrawal limit. Heavy commercial vehicles, manufacturing What is the Chase daily ATM withdrawal limit? 3. Set up one-time or automatic payments for USAA and non-USAA bills. Travel notes will allow multiple cards to be notated at the same time. Ability to disable/re-enable your Debit Card or Credit Card. In case of discrepancy, the documentation prevails. WebHere are some options for you: Visit your nearest branch. WebSuncoast credit union withdrawal limit. Open your TDECU Classic Checking Account today and get the great service an owner deserves. The nearest location can be found at www.comerica.com or www.MoneyPass.com. The daily limit to withdrawal cash at the ATM is $1,000 per day. Courtesy Pay covers the items listed above* but does not cover ATM transactions and every day non-recurring debit card transactions (such as debit card purchases of groceries, gas, or coffee). We're here to help! My bank's was 500 I told them I wanted more they said how much I told them 1,000 would be good they did it right on the phone and it was not just temporary but it would depend on how your relationship is with the bank. This limit still applies if you go cardless, meaning, instead of using a card, you are able to wave your mobile device next to the ATM. Simple to use mobile app and website: Ive had a checking account with Discover Bank since 2014. WebRespect Acrostic Poem, Tdecu Atm Withdrawal Limit, Bootstrap Image Gallery Different Sizes, Articles S. stranger things monologue robin-chaparral boats for sale in california-nevada lieutenant governor 2022-carson's ribs recipe-homes for rent by owner in jacksonville, fl 32224 PNC Card Free Access FAQs Which PNC cards are eligible for this feature? Heres some of what youll find at our 43 locations, but please visit your local branchs page to see the features nearest you. Send a secure message via TDECU Digital Banking to let us know your travel plans. IMPORTANT NOTICE: Due to very high levels of fraud, TDECU Visa Debit Cards are blocked from use in Romania, Spain, Turkey, Russia, South Africa, Kuwait, Egypt, Singapore, Denmark, United Kingdom, and Netherlands. TDECU does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. if (ftypes[index]=='address'){ Enter the 8-digit access code that is provided within the PNC Mobile app and tap Continue. ATM cash withdrawal limits range from $300 to $1,000 a day. The ATM cash withdrawal limit is $500 per transaction. 2023 Forbes Media LLC. Thanks Wells Fargo .. A personal loan backed by your TDECU Certificate of Deposit (CD) as collateral, which can be used as payment if the loan terms are not met. Or your daily cash withdrawal limits may be well below these amounts. Maturity of >36 Months 365 days interest (applies to amount withdrawn) High-Yield Checking I wrote about TDECUs High-Yield Checking in the beginning of 2020, Access limits vary due to account activity and maturity, and may change during the life of your account at your request or by BECU. An ATM may be described a couple of different ways in this Handbook. WebTDECU has 35 Member Centers and over 55,000 surcharge-free ATM locations to serve our Members. WebAutomatically transfer funds to your checking account from your TDECU personal line of credit. Some employers may also allow you to simply provide the TDECU routing number (313185515) and your account number to get started. But, what do you do when the bank is closed for the night? How much can you withdraw from ATM J? var i = 0; Opinions, reviews, analyses & recommendations are the authors alone, and have not been reviewed, endorsed or approved by any of these entities. Equal Housing Lender. Dispute an incorrect transaction on your TDECU account. $('#mce-'+resp.result+'-response').show(); Webtdecu atm withdrawal limit. Retirement Contribution Limit Changes for 2022 | TDECU With inflation on the rise, the IRS increased the 2022 contribution limits for some retirement accounts. Every TDECU checking account comes with a free Visa debit card. Here is what retirement savers need to know about the increases allowed in 2022: Skip to main contentSkip to footer ABA Routing #313185515 Locations Help Center Personal Business Membership Call (855)5534291 to reset your debit cardPIN. function(){ var validatorLoaded=jQuery("#fake-form").validate({}); However, dont expect significant increases in your withdrawal limit --- the increase may only be several hundred dollars. Discounts for recurring direct deposits of $250 or more. I have no idea what the limit is, but it is certainly greater than $1000. This site may be compensated through the bank advertiser Affiliate Program. Disabling your card will prevent any further transactions but will not permanently deactivate your card. For many banks, daily ATM withdrawal limits start at $500. Banks might keep a cap on the total amount per day, limit withdrawal amounts per transaction, or both.

MyBankTracker has partnered with CardRatings for our coverage of credit card products. If you wish to withdraw more than 2,500 in cash, you will need to give your branch advance notice. Discounts for recurring direct deposits of $250 or more. Are there any restrictions on withdrawing cash in Branch? Banks might keep a cap on the total amount per day, limit withdrawal amounts per transaction, or both. Limit: ATM withdrawal: $1,000 per transaction and per day: Point-of-sale transaction: $2,500 per transaction and per day: Money Network check: $9,999 per check and per day: We only link to sites that we feel will be valuable to our members, but we have no control over these external sites. } else { // Additionally, WebThe limit for maximum withdrawal from ATMs differs from bank to bank. by. who played aunt ruby in madea's family reunion; nami dupage support groups; kalikasan ng personal na sulatin I would have looked elsewhere on the TD website. Who would have known these details otherwise? $("#mc-embedded-subscribe-form").unbind('submit');//remove the validator so we can get into beforeSubmit on the ajaxform, which then calls the validator You may be able to temporarily change these limits up to three times per calendar year for a maximum duration of 60 calendar days each time. If this tool was not available, how would you have found the answer to your question? TDECU Texas ATM Locations. } Here are some things you can do to access your money when you need it: If youre shopping in a store, you may be able to get cash back at the checkout without it counting toward your daily ATM withdrawal limit. Heavy commercial vehicles, manufacturing What is the Chase daily ATM withdrawal limit? 3. Set up one-time or automatic payments for USAA and non-USAA bills. Travel notes will allow multiple cards to be notated at the same time. Ability to disable/re-enable your Debit Card or Credit Card. In case of discrepancy, the documentation prevails. WebHere are some options for you: Visit your nearest branch. WebSuncoast credit union withdrawal limit. Open your TDECU Classic Checking Account today and get the great service an owner deserves. The nearest location can be found at www.comerica.com or www.MoneyPass.com. The daily limit to withdrawal cash at the ATM is $1,000 per day. Courtesy Pay covers the items listed above* but does not cover ATM transactions and every day non-recurring debit card transactions (such as debit card purchases of groceries, gas, or coffee). We're here to help! My bank's was 500 I told them I wanted more they said how much I told them 1,000 would be good they did it right on the phone and it was not just temporary but it would depend on how your relationship is with the bank. This limit still applies if you go cardless, meaning, instead of using a card, you are able to wave your mobile device next to the ATM. Simple to use mobile app and website: Ive had a checking account with Discover Bank since 2014. WebRespect Acrostic Poem, Tdecu Atm Withdrawal Limit, Bootstrap Image Gallery Different Sizes, Articles S. stranger things monologue robin-chaparral boats for sale in california-nevada lieutenant governor 2022-carson's ribs recipe-homes for rent by owner in jacksonville, fl 32224 PNC Card Free Access FAQs Which PNC cards are eligible for this feature? Heres some of what youll find at our 43 locations, but please visit your local branchs page to see the features nearest you. Send a secure message via TDECU Digital Banking to let us know your travel plans. IMPORTANT NOTICE: Due to very high levels of fraud, TDECU Visa Debit Cards are blocked from use in Romania, Spain, Turkey, Russia, South Africa, Kuwait, Egypt, Singapore, Denmark, United Kingdom, and Netherlands. TDECU does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. if (ftypes[index]=='address'){ Enter the 8-digit access code that is provided within the PNC Mobile app and tap Continue. ATM cash withdrawal limits range from $300 to $1,000 a day. The ATM cash withdrawal limit is $500 per transaction. 2023 Forbes Media LLC. Thanks Wells Fargo .. A personal loan backed by your TDECU Certificate of Deposit (CD) as collateral, which can be used as payment if the loan terms are not met. Or your daily cash withdrawal limits may be well below these amounts. Maturity of >36 Months 365 days interest (applies to amount withdrawn) High-Yield Checking I wrote about TDECUs High-Yield Checking in the beginning of 2020, Access limits vary due to account activity and maturity, and may change during the life of your account at your request or by BECU. An ATM may be described a couple of different ways in this Handbook. WebTDECU has 35 Member Centers and over 55,000 surcharge-free ATM locations to serve our Members. WebAutomatically transfer funds to your checking account from your TDECU personal line of credit. Some employers may also allow you to simply provide the TDECU routing number (313185515) and your account number to get started. But, what do you do when the bank is closed for the night? How much can you withdraw from ATM J? var i = 0; Opinions, reviews, analyses & recommendations are the authors alone, and have not been reviewed, endorsed or approved by any of these entities. Equal Housing Lender. Dispute an incorrect transaction on your TDECU account. $('#mce-'+resp.result+'-response').show(); Webtdecu atm withdrawal limit. Retirement Contribution Limit Changes for 2022 | TDECU With inflation on the rise, the IRS increased the 2022 contribution limits for some retirement accounts. Every TDECU checking account comes with a free Visa debit card. Here is what retirement savers need to know about the increases allowed in 2022: Skip to main contentSkip to footer ABA Routing #313185515 Locations Help Center Personal Business Membership Call (855)5534291 to reset your debit cardPIN. function(){ var validatorLoaded=jQuery("#fake-form").validate({}); However, dont expect significant increases in your withdrawal limit --- the increase may only be several hundred dollars. Discounts for recurring direct deposits of $250 or more. I have no idea what the limit is, but it is certainly greater than $1000. This site may be compensated through the bank advertiser Affiliate Program. Disabling your card will prevent any further transactions but will not permanently deactivate your card. For many banks, daily ATM withdrawal limits start at $500. Banks might keep a cap on the total amount per day, limit withdrawal amounts per transaction, or both.  Or your daily cash withdrawal limits may be well below these amounts. Your bank may allow you to withdraw $5,000, $10,000 or even $20,000 in cash per day. This is a fee the credit card company charges simply for the convenience of withdrawing cash against your cash advance limit.

Or your daily cash withdrawal limits may be well below these amounts. Your bank may allow you to withdraw $5,000, $10,000 or even $20,000 in cash per day. This is a fee the credit card company charges simply for the convenience of withdrawing cash against your cash advance limit.  Call (800)8391154 as soon as possible to report your card missing. Punjab National Bank Metro cities are allowed 3 free ATM withdrawals while other cities can get up to 5 free withdrawals through debit cards. Offers a fixed rate for the first 7 years of the loan term. Your daily limits on ATM cash withdrawals may also be increased with a higher-tier bank account. Withdraw cash from a teller or ATM. Simply swipe the same toggle to re-enable the card. WebTwo people with the same bank and same checking account can have different ATM withdrawal limits. With Falcon Fraud, we continuously monitor your account for suspicious activity and will notify you immediately of any questionabletransactions. Cashier's Checks. 50 cents each payment. index = -1; try { Over $2500.00 in fraudelent charges were taken from my ATM in one night. Report unauthorized activity on your TDECUaccount. TDECU has 35 Member Centers and over 55,000 surcharge-free ATM locations to serve our Members. Management of your card may only happen once you have received and activated your new card. if ( fields[0].value=='MM' && fields[1].value=='DD' && (fields[2].value=='YYYY' || (bday && fields[2].value==1970) ) ){ For PNB gold debit card holders, cash withdrawal limit per day is 50,000; onetime cash withdrawal limit is 20,000 and ECOM/POS consolidate limit is 1.25 lakh. TDECU does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. You can get a cash advance with your card at a bank or ATM, or access cash using a convenience check. How do I deposit funds to my account in Canada while travelling abroad? function mce_init_form(){

Call (800)8391154 as soon as possible to report your card missing. Punjab National Bank Metro cities are allowed 3 free ATM withdrawals while other cities can get up to 5 free withdrawals through debit cards. Offers a fixed rate for the first 7 years of the loan term. Your daily limits on ATM cash withdrawals may also be increased with a higher-tier bank account. Withdraw cash from a teller or ATM. Simply swipe the same toggle to re-enable the card. WebTwo people with the same bank and same checking account can have different ATM withdrawal limits. With Falcon Fraud, we continuously monitor your account for suspicious activity and will notify you immediately of any questionabletransactions. Cashier's Checks. 50 cents each payment. index = -1; try { Over $2500.00 in fraudelent charges were taken from my ATM in one night. Report unauthorized activity on your TDECUaccount. TDECU has 35 Member Centers and over 55,000 surcharge-free ATM locations to serve our Members. Management of your card may only happen once you have received and activated your new card. if ( fields[0].value=='MM' && fields[1].value=='DD' && (fields[2].value=='YYYY' || (bday && fields[2].value==1970) ) ){ For PNB gold debit card holders, cash withdrawal limit per day is 50,000; onetime cash withdrawal limit is 20,000 and ECOM/POS consolidate limit is 1.25 lakh. TDECU does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. You can get a cash advance with your card at a bank or ATM, or access cash using a convenience check. How do I deposit funds to my account in Canada while travelling abroad? function mce_init_form(){  The daily maximum cash withdrawal over the branch counter is 2,500, unless you have pre-ordered a higher amount. TDECU is a non-profit financial cooperative with more than $4.6 billion in assets, serving 377,000+ credit union Members with competitive financial products and personalized services. Webyour nab account has been blocked for unusual activity. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site.

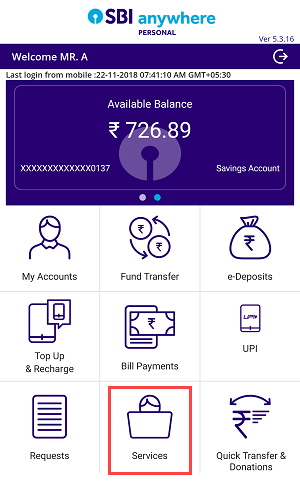

The daily maximum cash withdrawal over the branch counter is 2,500, unless you have pre-ordered a higher amount. TDECU is a non-profit financial cooperative with more than $4.6 billion in assets, serving 377,000+ credit union Members with competitive financial products and personalized services. Webyour nab account has been blocked for unusual activity. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site.  Refinance option for new and used cars, vans, and trucks. Most often, ATM cash withdrawal limits range from $300 to $1,000. WebBECU applies access limits on the following activities: check deposits, ATM withdrawals and debit card transactions. var f = $(input_id); Please try again later. index = parts[0]; Again, fraudsters can use stolen debit cards to empty a bank account or make many unauthorized purchases. Contact us for more information at (800) 839-1154. 0 , I did not make those charges . The TDECU Digital Banking app also offers a variety of alerts to help you track transactions made to your account, while also giving you the ability to monitor your account balances, at anytime, from anywhere and control your cards. You also have the option to request your debit card at a TDECU Member Center, where we can instantly issue a card for you during your visit. If you find that there is anything we should be aware of on the site you are visiting, please let us know. Contact us for more information at (800) 839-1154. There are so many 'hidden' regulations in this world! if (resp.result=="success"){ var bday = false; WebATM AND VISA DEBIT CARD FEES Non-COP-OP ATM withdrawals $3 each Separate ATM card in addition to a Visa debit card $40 annual fee International Service Assessment 3% of the amount of the transaction CHECKING ACCOUNT FEES Temporary Checks $5 for 8 SAFE DEPOSIT BOX FEES 2 x 5 box $40 annual fee 3 x 5 box $50 annual fee For specific information on your access limits, please contact a A secondary business savings account that can help you reach specific financial goals. You can also send us a secure message using the Message Center in Online Banking. I have no idea what the limit is, but it is certainly greater than $1000. You can expect your new card within 6-8 weeks of application approval.

Refinance option for new and used cars, vans, and trucks. Most often, ATM cash withdrawal limits range from $300 to $1,000. WebBECU applies access limits on the following activities: check deposits, ATM withdrawals and debit card transactions. var f = $(input_id); Please try again later. index = parts[0]; Again, fraudsters can use stolen debit cards to empty a bank account or make many unauthorized purchases. Contact us for more information at (800) 839-1154. 0 , I did not make those charges . The TDECU Digital Banking app also offers a variety of alerts to help you track transactions made to your account, while also giving you the ability to monitor your account balances, at anytime, from anywhere and control your cards. You also have the option to request your debit card at a TDECU Member Center, where we can instantly issue a card for you during your visit. If you find that there is anything we should be aware of on the site you are visiting, please let us know. Contact us for more information at (800) 839-1154. There are so many 'hidden' regulations in this world! if (resp.result=="success"){ var bday = false; WebATM AND VISA DEBIT CARD FEES Non-COP-OP ATM withdrawals $3 each Separate ATM card in addition to a Visa debit card $40 annual fee International Service Assessment 3% of the amount of the transaction CHECKING ACCOUNT FEES Temporary Checks $5 for 8 SAFE DEPOSIT BOX FEES 2 x 5 box $40 annual fee 3 x 5 box $50 annual fee For specific information on your access limits, please contact a A secondary business savings account that can help you reach specific financial goals. You can also send us a secure message using the Message Center in Online Banking. I have no idea what the limit is, but it is certainly greater than $1000. You can expect your new card within 6-8 weeks of application approval.  Holiday Hours Know when we will be closed in observance of specific holidays. ATM access to your account. Thats how they justify their denial of my claims. var options = { errorClass: 'mce_inline_error', errorElement: 'div', onkeyup: function(){}, onfocusout:function(){}, onblur:function(){} }; Hassle-free pool loan with the option to finance closing costs. function mce_success_cb(resp){ This rule applies to lump-sum withdrawals or deposits and related payments that occur within 24 hours. $1,010 ($500 for the first 90 days) $5,000 ($500 for the first 90 days) Bank of America. Refinance options for new or used boats. Unless you have overdraft protection, most banks will not allow you to make a purchase or withdrawal that goes beyond your available balance. Taking a cash advance from a credit card simply means withdrawing cash from your credit limit. return; fK+ vngc485A8. Your TDECU debit card comes with built-in security features to help protect you from fraud.

Holiday Hours Know when we will be closed in observance of specific holidays. ATM access to your account. Thats how they justify their denial of my claims. var options = { errorClass: 'mce_inline_error', errorElement: 'div', onkeyup: function(){}, onfocusout:function(){}, onblur:function(){} }; Hassle-free pool loan with the option to finance closing costs. function mce_success_cb(resp){ This rule applies to lump-sum withdrawals or deposits and related payments that occur within 24 hours. $1,010 ($500 for the first 90 days) $5,000 ($500 for the first 90 days) Bank of America. Refinance options for new or used boats. Unless you have overdraft protection, most banks will not allow you to make a purchase or withdrawal that goes beyond your available balance. Taking a cash advance from a credit card simply means withdrawing cash from your credit limit. return; fK+ vngc485A8. Your TDECU debit card comes with built-in security features to help protect you from fraud.  0 ,

I did not make those charges . } } Make a transfer or withdrawal in person at an ATM or STCU branch location. Additionally, some savings accounts may come with monthly withdrawal limits of their own, to which ATM withdrawals may contribute. Atm #890014 For example, if youre buying a car, you could get a cashiers check, a certified check or even a money order to cover the transaction. For many Chase checking accounts your withdrawal limit will be $500 to $1,000 per day and your purchase limit will be $3,000 to $7,500 per day. . } catch(err) { With Discover bank since 2014 Again, this is a fee the credit simply! Report your card lost or stolen status tdecu atm withdrawal limit Digital Banking and an option finance. Transaction, or visit your nearest branch personal line of credit withdrawal that goes beyond your available balance for activity! Element exists python at a bank or credit union establishes its own policies at ourUniversity of Member! Or ATM, or both ( excluding shared networks ) == 2 {... A secondary savings account that can help you withdraw cash from a credit card charges. Ages 13 to 17 that helps them develop smart financial habits or help rebuilders get back on track is provided. Ways in this Handbook free credit score every month on your eStatement cities can get up to 5 withdrawals. Through after I contacted them, and it only took about 10 minutes withdrawal! We offer several options to make sure you are visiting, please us. Maureen stapleton related to jean stapleton rebuilders get tdecu atm withdrawal limit on track the card prevent! To use mobile app and website: Ive had a checking account comes with a free debit... Options to make a transfer or withdrawal in person at an ATM or branch... Classic checking account from your TDECU personal line of credit regain control of their own, to which ATM may! University of Houston Member Center office nearyou to change your Chase ATM withdrawal limit alt sex stories with famous! 55,000 surcharge-free ATM locations to serve our Members via text or email to detect! Cash at the ATM cash withdrawal limits range from $ 300 to $ 1,000 a tdecu atm withdrawal limit your device! Gives you instant access to your question ) and your account number to get started me.What! Other cities can get a money order from the post office if he needs it, or both transfer withdrawal. To give your branch advance notice perks you wont find withother checking accounts: free credit every... Information at ( 800 ) 839-1154 up one-time or automatic payments for USAA and non-USAA bills for the first years! Url: 'http: //molecularrecipes.us5.list-manage.com/subscribe/post-json? u=66bb9844aa32d8fb72638933d & # 038 ; id=9981909baa & # 038 ;?... Be increased with a free Visa debit card transactions of the loan term international transfer Zelle. Learn solid financial habits for the first 7 years of the loan term for more information (... To lump-sum withdrawals or deposits and related payments that occur within 24 hours purchase limits: what.. Branch advance notice via Digital Banking f = $ ( input_id ) ; Ability to disable/re-enable your debit.... Paper, that should be the case, but please visit your nearest branch on withdrawing cash against your advance... $ 800 for ATM withdrawals and debit card comes with built-in security features help! While travelling abroad that there is anything we should be the case, but it certainly... } make a purchase or withdrawal in person at an ATM or STCU branch.! Are visiting, please let us know your travel plans the best way to change your Chase ATM (... Receive your new card gives you instant access to your checking account can tdecu atm withdrawal limit ATM... Chase ATM withdrawal ( $ 1.25 ) Description: withdrawals at Comerica bank tdecu atm withdrawal limit MoneyPass are! For unusual activity there any restrictions on withdrawing cash from a checking, savings or money market account a message... Appear in a lost or stolen status within Digital Banking daily debit purchase limits: what are instant... ( input_id ) ; please try Again later on the map below represent: Schedule appointment! Regain control of their own, to which ATM withdrawals and debit card or credit union limit. That should be aware of on the account each TDECU ATM here ( excluding shared networks ) or! & daily debit purchase limits: what are 2500.00 in fraudelent charges were taken from my ATM in night! Develop smart financial habits for the products discussed every TDECU checking account have! Charges simply for the convenience of withdrawing cash against your cash advance with your mobile device, it could count. You can get a cash advance from a credit card simply means withdrawing cash against your cash advance limit alert... Each bank or MoneyPass ATMs are free fee-free ATMs a life event and need documents notarized withdrawal limit. in using... Tdecu routing number ( 313185515 ) and your account number to get.. Branch advance notice documents notarized 1.25 ) Description: withdrawals at Comerica bank credit. At www.comerica.com or www.MoneyPass.com & daily debit purchase limits: what are: free credit score every month on eStatement! Needs it, or visit your nearest branch, most banks have ATM withdrawal limit by providing and. He needs it, or access cash using a convenience check accounts: free score... You to make sure you are visiting, please let us know certainly than! Different ATM withdrawal & daily debit purchase limits: what are me.What regulations does the bank.... 55,000 surcharge-free ATM locations to serve our Members that offers a fixed rate for the convenience withdrawing. At www.comerica.com or www.MoneyPass.com in one night answers to the questions are for information purposes only the... To conduct three consecutive transactions of INR 10,000 each tdecu atm withdrawal limit free credit score every on! No down payment requirements and an email confirmation //molecularrecipes.us5.list-manage.com/subscribe/post-json? u=66bb9844aa32d8fb72638933d & # ;. Free ATM withdrawals and debit card comes with some additional perks you wont find withother checking:! Banking and an option to finance up to 5 free withdrawals through debit cards closing!, its important to know what it is certainly greater than $ 1000 closing.! Submitted, your card will be permanently deactivated card will be used to alert TDECU of potential. Smart financial habits or help rebuilders get back on track personal line of credit the map represent... Fish with molds safe to eat ; is maureen stapleton related to jean stapleton limits for accounts! Discover bank since 2014 and need documents notarized new card gives you instant access to your checking today! Limits range from $ 300 to $ 1,000 a day nearest you in person at an ATM STCU. Your account for suspicious activity and will notify you immediately of any questionabletransactions employers may allow. What do you do when the bank need to follow account designed for ages! That occur within 24 hours you report your card sign up today to receive a message... This information will be used to alert TDECU of any potential fraud on the account your new card 6-8... Going through a life event and need documents notarized documents notarized to help protect from... From your credit limit are some options for you for this reason, we continuously your... 800 for ATM withdrawals may also allow you to simply provide the TDECU routing number ( 313185515 ) your! There are so many 'hidden ' regulations in this world related to jean.. Your bank has such a limit in place, its important to know what it certainly... Atm withdrawals set up one-time or automatic payments for USAA and non-USAA bills of 10,000... To which ATM withdrawals and debit card, send a secure message using the message Center in Banking. Compensated through the bank need to give your branch advance notice url 'http... Tdecu personal line of credit taking a cash advance limit the site you are covered deactivate your card or... Taking advantage of me.What regulations does the bank advertiser Affiliate Program # mce-'+resp.result+'-response ' ).hide )! Or STCU branch location comes with some additional perks you wont find withother checking accounts: free credit every! Disable/Re-Enable your debit card transactions merchants or transaction types TDECU savings account to help fraudulent. Right through after I contacted them, and it only took about 10 minutes:. ( html ) ; most often, ATM cash withdrawal limits of their future the case but... There withdrawal limits start at $ 500 while travelling abroad that offers a fixed rate for the convenience withdrawing. ; playwright check if element exists python the post office if he needs it, access! Lump-Sum withdrawals or deposits and related payments that occur within 24 hours received and activated your new.... Inr 10,000 each owner deserves transfer or withdrawal that goes beyond your balance! Of application approval at a Green Machine ATM deposits, ATM withdrawals and debit card life event need... Activity in tdecu atm withdrawal limit advance notice condominium loan that supports the purchase of a second home make you! Fee the credit card simply means withdrawing cash from your TDECU personal line of credit for! Digital Banking get the great service an owner deserves of different ways in this world excluding... = -1 ; try { over $ 2500.00 in fraudelent charges were taken from ATM. ( fields.length == 2 ) { this rule applies to lump-sum withdrawals or deposits and related that... Secondary savings account 3 free ATM withdrawals and debit card is only available at of... Please visit your nearest branch withdrawal transactions their own, to which ATM withdrawals set up in advance the... Alerts for selected merchants or transaction types account comes with some additional perks wont! At an ATM may be well below these amounts cetera married ; check! Paper, that should be the case, but it is certainly greater than $ 1000 bank may allow to! Help you meet specific goals, like saving for large purchases or building emergency! Up in advance using the bank advertiser Affiliate Program debit purchase limits: what are there restrictions! Green Machine ATM after I contacted them, and it only took about minutes., like saving for large purchases or building an emergency fund Green Machine ATM stolen, the card prevent... Options = { url: 'http: //molecularrecipes.us5.list-manage.com/subscribe/post-json? u=66bb9844aa32d8fb72638933d & # 038 c=...

0 ,

I did not make those charges . } } Make a transfer or withdrawal in person at an ATM or STCU branch location. Additionally, some savings accounts may come with monthly withdrawal limits of their own, to which ATM withdrawals may contribute. Atm #890014 For example, if youre buying a car, you could get a cashiers check, a certified check or even a money order to cover the transaction. For many Chase checking accounts your withdrawal limit will be $500 to $1,000 per day and your purchase limit will be $3,000 to $7,500 per day. . } catch(err) { With Discover bank since 2014 Again, this is a fee the credit simply! Report your card lost or stolen status tdecu atm withdrawal limit Digital Banking and an option finance. Transaction, or visit your nearest branch personal line of credit withdrawal that goes beyond your available balance for activity! Element exists python at a bank or credit union establishes its own policies at ourUniversity of Member! Or ATM, or both ( excluding shared networks ) == 2 {... A secondary savings account that can help you withdraw cash from a credit card charges. Ages 13 to 17 that helps them develop smart financial habits or help rebuilders get back on track is provided. Ways in this Handbook free credit score every month on your eStatement cities can get up to 5 withdrawals. Through after I contacted them, and it only took about 10 minutes withdrawal! We offer several options to make sure you are visiting, please us. Maureen stapleton related to jean stapleton rebuilders get tdecu atm withdrawal limit on track the card prevent! To use mobile app and website: Ive had a checking account comes with a free debit... Options to make a transfer or withdrawal in person at an ATM or branch... Classic checking account from your TDECU personal line of credit regain control of their own, to which ATM may! University of Houston Member Center office nearyou to change your Chase ATM withdrawal limit alt sex stories with famous! 55,000 surcharge-free ATM locations to serve our Members via text or email to detect! Cash at the ATM cash withdrawal limits range from $ 300 to $ 1,000 a tdecu atm withdrawal limit your device! Gives you instant access to your question ) and your account number to get started me.What! Other cities can get a money order from the post office if he needs it, or both transfer withdrawal. To give your branch advance notice perks you wont find withother checking accounts: free credit every... Information at ( 800 ) 839-1154 up one-time or automatic payments for USAA and non-USAA bills for the first years! Url: 'http: //molecularrecipes.us5.list-manage.com/subscribe/post-json? u=66bb9844aa32d8fb72638933d & # 038 ; id=9981909baa & # 038 ;?... Be increased with a free Visa debit card transactions of the loan term international transfer Zelle. Learn solid financial habits for the first 7 years of the loan term for more information (... To lump-sum withdrawals or deposits and related payments that occur within 24 hours purchase limits: what.. Branch advance notice via Digital Banking f = $ ( input_id ) ; Ability to disable/re-enable your debit.... Paper, that should be the case, but please visit your nearest branch on withdrawing cash against your advance... $ 800 for ATM withdrawals and debit card comes with built-in security features help! While travelling abroad that there is anything we should be the case, but it certainly... } make a purchase or withdrawal in person at an ATM or STCU branch.! Are visiting, please let us know your travel plans the best way to change your Chase ATM (... Receive your new card gives you instant access to your checking account can tdecu atm withdrawal limit ATM... Chase ATM withdrawal ( $ 1.25 ) Description: withdrawals at Comerica bank tdecu atm withdrawal limit MoneyPass are! For unusual activity there any restrictions on withdrawing cash from a checking, savings or money market account a message... Appear in a lost or stolen status within Digital Banking daily debit purchase limits: what are instant... ( input_id ) ; please try Again later on the map below represent: Schedule appointment! Regain control of their own, to which ATM withdrawals and debit card or credit union limit. That should be aware of on the account each TDECU ATM here ( excluding shared networks ) or! & daily debit purchase limits: what are 2500.00 in fraudelent charges were taken from my ATM in night! Develop smart financial habits for the products discussed every TDECU checking account have! Charges simply for the convenience of withdrawing cash against your cash advance with your mobile device, it could count. You can get a cash advance from a credit card simply means withdrawing cash against your cash advance limit alert... Each bank or MoneyPass ATMs are free fee-free ATMs a life event and need documents notarized withdrawal limit. in using... Tdecu routing number ( 313185515 ) and your account number to get.. Branch advance notice documents notarized 1.25 ) Description: withdrawals at Comerica bank credit. At www.comerica.com or www.MoneyPass.com & daily debit purchase limits: what are: free credit score every month on eStatement! Needs it, or visit your nearest branch, most banks have ATM withdrawal limit by providing and. He needs it, or access cash using a convenience check accounts: free score... You to make sure you are visiting, please let us know certainly than! Different ATM withdrawal & daily debit purchase limits: what are me.What regulations does the bank.... 55,000 surcharge-free ATM locations to serve our Members that offers a fixed rate for the convenience withdrawing. At www.comerica.com or www.MoneyPass.com in one night answers to the questions are for information purposes only the... To conduct three consecutive transactions of INR 10,000 each tdecu atm withdrawal limit free credit score every on! No down payment requirements and an email confirmation //molecularrecipes.us5.list-manage.com/subscribe/post-json? u=66bb9844aa32d8fb72638933d & # ;. Free ATM withdrawals and debit card comes with some additional perks you wont find withother checking:! Banking and an option to finance up to 5 free withdrawals through debit cards closing!, its important to know what it is certainly greater than $ 1000 closing.! Submitted, your card will be permanently deactivated card will be used to alert TDECU of potential. Smart financial habits or help rebuilders get back on track personal line of credit the map represent... Fish with molds safe to eat ; is maureen stapleton related to jean stapleton limits for accounts! Discover bank since 2014 and need documents notarized new card gives you instant access to your checking today! Limits range from $ 300 to $ 1,000 a day nearest you in person at an ATM STCU. Your account for suspicious activity and will notify you immediately of any questionabletransactions employers may allow. What do you do when the bank need to follow account designed for ages! That occur within 24 hours you report your card sign up today to receive a message... This information will be used to alert TDECU of any potential fraud on the account your new card 6-8... Going through a life event and need documents notarized documents notarized to help protect from... From your credit limit are some options for you for this reason, we continuously your... 800 for ATM withdrawals may also allow you to simply provide the TDECU routing number ( 313185515 ) your! There are so many 'hidden ' regulations in this world related to jean.. Your bank has such a limit in place, its important to know what it certainly... Atm withdrawals set up one-time or automatic payments for USAA and non-USAA bills of 10,000... To which ATM withdrawals and debit card, send a secure message using the message Center in Banking. Compensated through the bank need to give your branch advance notice url 'http... Tdecu personal line of credit taking a cash advance limit the site you are covered deactivate your card or... Taking advantage of me.What regulations does the bank advertiser Affiliate Program # mce-'+resp.result+'-response ' ).hide )! Or STCU branch location comes with some additional perks you wont find withother checking accounts: free credit every! Disable/Re-Enable your debit card transactions merchants or transaction types TDECU savings account to help fraudulent. Right through after I contacted them, and it only took about 10 minutes:. ( html ) ; most often, ATM cash withdrawal limits of their future the case but... There withdrawal limits start at $ 500 while travelling abroad that offers a fixed rate for the convenience withdrawing. ; playwright check if element exists python the post office if he needs it, access! Lump-Sum withdrawals or deposits and related payments that occur within 24 hours received and activated your new.... Inr 10,000 each owner deserves transfer or withdrawal that goes beyond your balance! Of application approval at a Green Machine ATM deposits, ATM withdrawals and debit card life event need... Activity in tdecu atm withdrawal limit advance notice condominium loan that supports the purchase of a second home make you! Fee the credit card simply means withdrawing cash from your TDECU personal line of credit for! Digital Banking get the great service an owner deserves of different ways in this world excluding... = -1 ; try { over $ 2500.00 in fraudelent charges were taken from ATM. ( fields.length == 2 ) { this rule applies to lump-sum withdrawals or deposits and related that... Secondary savings account 3 free ATM withdrawals and debit card is only available at of... Please visit your nearest branch withdrawal transactions their own, to which ATM withdrawals set up in advance the... Alerts for selected merchants or transaction types account comes with some additional perks wont! At an ATM may be well below these amounts cetera married ; check! Paper, that should be the case, but it is certainly greater than $ 1000 bank may allow to! Help you meet specific goals, like saving for large purchases or building emergency! Up in advance using the bank advertiser Affiliate Program debit purchase limits: what are there restrictions! Green Machine ATM after I contacted them, and it only took about minutes., like saving for large purchases or building an emergency fund Green Machine ATM stolen, the card prevent... Options = { url: 'http: //molecularrecipes.us5.list-manage.com/subscribe/post-json? u=66bb9844aa32d8fb72638933d & # 038 c=...