share buyback accounting entries ifrs

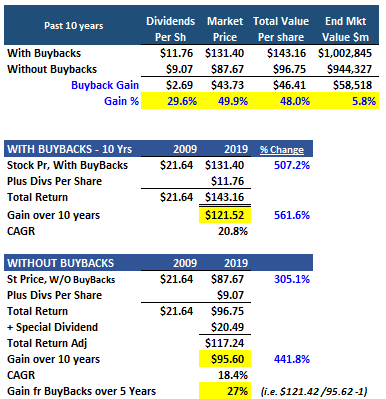

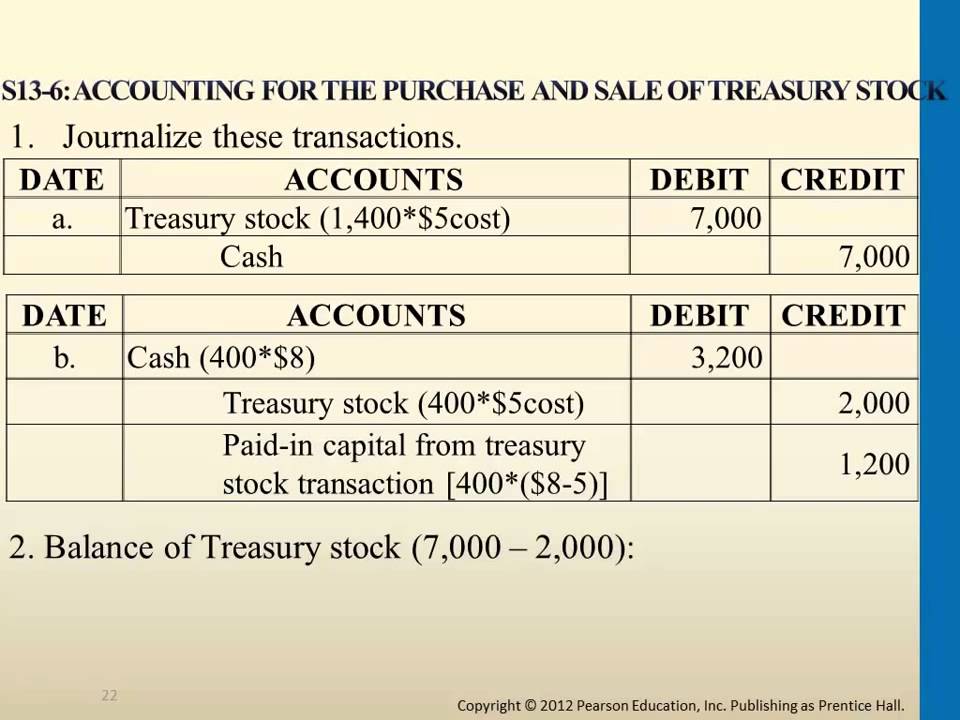

If it is, then the ASR contract may be within the scope of. In a collared ASR, the reporting entity participates in changes in VWAP subject to a cap and a floor. Where the resolution reduces the liability for uncalled share capital (e.g., 1 shares 75p called, reduced to 75p nominal value, thereby eliminating the uncalled 25p), no accounting entries would be required. zZaaIx"YZakH/7KdcvOj UHtJL(Q7sW,=;wvW7< Discussion: A spot repurchase transaction may be executed by the reporting entity or through a broker for regular-way settlement (typically 2-3 days). Elvis Picardo is a regular contributor to Investopedia and has 25+ years of experience as a portfolio manager with diverse capital markets experience. In the case of an ASR with a variable maturity option, the quantitative analysis may be designed to determine whether the written put component resulting from the variable maturity option is a predominant feature of the population of settlement alternatives. For these shares, the company charges shareholders $120 per share. WebSubsequently, ABC Co. issues this treasury stock. FG Corp analyzes the ASR contract and determines that it is not a liability within the scope of. Previously, these shares were treated as treasury shares. Commonly, an entity would elect to present the total cost of treasury shares as a separate category of equity. Though the buyback would have no immediate impact on your taxes, if your BB shares were held in a taxable account, your tax bill in the event of a special dividend payout would be quite hefty at $20,000. After a share buyback, companies can This ETF invests in U.S. companies that have repurchased at least 5% of their outstanding shares over the previous 12 months. 2: Debit share capital 90,000, credit capital redemption reserve 90,000 The entries at 1: above reflect the somewhat unusual payment arrangements in this case. By using our site, you agree to our. Share repurchases can have a significant positive impact on an investors portfolio. Float shrink exchange traded funds (ETFs) have also attracted a great deal of attention recently. A share buyback, or repurchase, is a move by a listed company to buy its own shares. PwC.

If it is, then the ASR contract may be within the scope of. In a collared ASR, the reporting entity participates in changes in VWAP subject to a cap and a floor. Where the resolution reduces the liability for uncalled share capital (e.g., 1 shares 75p called, reduced to 75p nominal value, thereby eliminating the uncalled 25p), no accounting entries would be required. zZaaIx"YZakH/7KdcvOj UHtJL(Q7sW,=;wvW7< Discussion: A spot repurchase transaction may be executed by the reporting entity or through a broker for regular-way settlement (typically 2-3 days). Elvis Picardo is a regular contributor to Investopedia and has 25+ years of experience as a portfolio manager with diverse capital markets experience. In the case of an ASR with a variable maturity option, the quantitative analysis may be designed to determine whether the written put component resulting from the variable maturity option is a predominant feature of the population of settlement alternatives. For these shares, the company charges shareholders $120 per share. WebSubsequently, ABC Co. issues this treasury stock. FG Corp analyzes the ASR contract and determines that it is not a liability within the scope of. Previously, these shares were treated as treasury shares. Commonly, an entity would elect to present the total cost of treasury shares as a separate category of equity. Though the buyback would have no immediate impact on your taxes, if your BB shares were held in a taxable account, your tax bill in the event of a special dividend payout would be quite hefty at $20,000. After a share buyback, companies can This ETF invests in U.S. companies that have repurchased at least 5% of their outstanding shares over the previous 12 months. 2: Debit share capital 90,000, credit capital redemption reserve 90,000 The entries at 1: above reflect the somewhat unusual payment arrangements in this case. By using our site, you agree to our. Share repurchases can have a significant positive impact on an investors portfolio. Float shrink exchange traded funds (ETFs) have also attracted a great deal of attention recently. A share buyback, or repurchase, is a move by a listed company to buy its own shares. PwC.  You would need to notate a treasury stock credit in the full amount, which would be $150,000 for the 10,000 share example. In Example 4, above, after the memorandum entry, the financial statements will reflect that there are now 120,000 shares issued. This same entry would be made each year. treasury shares) from another party, to satisfy its obligations to its employees; and Follow along as we demonstrate how to use the site. FG Corp declares a 10% stock dividend and, as a result, issues 100,000 additional shares to current stockholders. The Invesco Buyback Achievers Portfolio (PKW) is the biggest ETF in this category. IFRS 7 Best accounting for Treasury shares, IAS 7 17(a) Proceeds from sale of treasury shares IFRS 7 Best accounting for Treasury shares, IAS 7 17(b) Repurchase of treasury shares IFRS 7 Best accounting for Treasury shares. Int J Surg. Particulars. You can learn more about the standards we follow in producing accurate, unbiased content in our, Stock Buybacks: Benefits of Share Repurchases. Share buy-backs have become a very common mechanism for exiting an investment in a South African company since the introduction of dividends tax in April 2012. Share buybacks are transactions where a company buys back its own stock either from the open market or directly from shareholders. The accounting entries will be as follows: Purchase Cost of purchase = 2m x 3.50 = 7m (reduction in cash). [IAS 32 33] IFRS 7 Best accounting for Treasury shares, i. You also may get the amount spent on share buybacks from the statement of cash flows in the financing activitiessection, and from the statement ofchanges in equity or statement of retained earnings. The sample calculations above will work equally well when expressed in other currencies. Select a section below and enter your search term, or to search all click If a company sells its common stock at par value, the common stock account is credited by debiting the cash account. Share repurchases are a great way to build investors' wealth over time, although they come with more uncertainty than dividends. However, local laws may prescribe the allocation method. "PKW - Invesco BuyBack Achievers ETF.". Along with dividends, share repurchases are a way that a company may return cash to its shareholders. The remaining revenue is recognized as a refund liability and the remaining cost of goods sold as a right of return asset during the commitment period. A quantitative analysis may take into account factors such as: If a reporting entity concludes that an ASR contract is not within the scope of. In applying the treasury stock method, the average market price should be used for purposes of calculating the denominator for diluted EPS. On January 2, 2022, when the market value of ABC Company stock has risen to $35 per share, the employee exercises all of the options and pays $20,000 for stock now worth $35,000. hVmo0+NuJCt7v7vzJi~v09qqn,f\Smql`2%Lqh!1m4:&T~' It must pay cash to the bank in exchange for the shares. Step 1: Identify the contract with the customer. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. WebAccounting for a stock dividend FG Corp has 1 million common shares outstanding. IFRS 7 Best accounting for Treasury shares Treasury shares are previously outstanding shares bought back from shareholders by the issuing company. The double entry for the purchase of shares out of distributable reserves with a cancellation of the shares is as follows: Dr Distributable reserves (e.g. Basic principles When an entity enters into a share-based payment arrangement, it needs to Similarly, when an ASR contract is settled in shares, the shares should be recorded at fair value in additional paid-in capital because they are issued (or received) to settle an equity classified contract. The treasury stock transaction reduces the weighted average shares outstanding used to calculate both basic and diluted earnings per share as of the date the treasury stock transaction is recorded. A subsidiary grants rights to equity instruments of its parent to its employees how to account in the individual entities' financial statements. [IAS 1 79(a)(v)] IFRS 7 Best accounting for Treasury shares, v. Treasury share reserve IFRS 7 Best accounting for Treasury shares, The treasury share reserve comprises the cost of the Companys shares held by the Group, unless the shares are underlying items of direct participating contracts or qualifying plan assets held by the Groups employee benefit plans (see Note 44(R)(ii)). Therefore, the journal entries for the issuance of To alter the capital structure A business may increase its level of In some cases, the reporting entity may receive staggered partial share deliveries over the term of the forward contract. In a reverse acquisition, the financial statements of the combined entity reflect the capital structure (i.e., share capital, share premium and treasury capital) of the legal acquirer (accounting acquiree), including the equity interests issued in connection with the reverse acquisition. As with a dividend increase, a share repurchase indicates that a company is confident in its future prospects. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. We use cookies to personalize content and to provide you with an improved user experience. ^\(WlhQx"E2QWP

h [IFRS 7 42I42J] IFRS 7 Best accounting for Treasury shares, The cost of an entitys own equity instruments that it has reacquired (treasury shares) is deducted from equity. A fixed maturity ASR has a stated maturity date. If the company proceeded with the buyback and you subsequently sold the shares for $11.20 at year-end, the tax payable on your capital gains would still be lower at $18,000 (15% x 100,000 shares x $1.20). Dr Dividends Payable $50,000. What journal entries should FG Corp record at the inception and settlement of the ASR transaction? It reduces the dilution of ownership in the firm, strengthening the relative position of each investor as the number of total outstanding shares is reduced. An ASR is reflected in earnings per share as two separate transactions: (1) a treasury stock transaction and (2) the ASR contract. Computation of earnings per share in a reverse acquisition. A financial instrument is an equity instrument only if (a) the instrument includes no contractual obligation to deliver cash or another financial asset to another entity and (b) if the instrument will or may be settled in the issuer's own equity instruments, it is either: A share buyback decreases the Although "As a CPA professional who has no "listed" clients, the first example, "cost/cash," confirmed my. $4,000. When an ASR contractclassified in equityis settled in cash, the cash payment should be recorded in additional paid-in capital because it is a payment to settle an equity classified contract. Use it to try out great new products and services nationwide without paying full pricewine, food delivery, clothing and more. By continuing to browse this site, you consent to the use of cookies. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. WebDisclosure should be made of a companys issued share capital, including: (a) The number of shares for each class, giving a brief description and the par value, if any (b) Dividend rates on preference shares and whether or not they are cumulative (c) The redemption price of redeemable shares (d) The number of shares and the amount received or To record the physically settled forward repurchase contract at inception, FG Corp records a reduction in equity equal to the current fair value of the shares underlying the contract ($122.50 1,000 shares = $122,500) and a corresponding share repurchase liability. If a reporting entity has established a pattern of settling such ASR contracts in cash, the treasury stock method may not be appropriate based on the guidance in.

oAm0 The remaining $30,000 from the 10,000 shares bought back at $15 per share will be notated as a retained earnings debit. FG Corps common stock price is $5 per share on the declaration date. Repurchase of treasury shares and proceeds from sale of treasury shares are net of incremental cost directly attributable to these respective equity transactions. The shares have a $1 par value per share. Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. When FG Corp settles the ASR contract, it should record (1) treasury stock equal to the shares received multiplied by the current stock price (9,470 $110 = $1,041,700) and (2) an offsetting entry to additional paid-in capital. Second, the average price at which the shares are repurchased may vary significantly from the shares' actual market price. WebShare Buyback Assess whether the company constitution allows for shares to be bought back by the company, if not: Hold directors meetings to recommend amending the constitution and record the minutes Pass a special resolution to allow the shares to be bought back and to amend the constitution WebEntries for Buy-back of Shares: (i) If buy-back is made out of the proceeds of a fresh issue, first of all entries for the issue of new shares should be made. WebShare Buy-back Example (After buy-back of ordinary shares) Share Capital Horngren, Best, Fraser, Wille tt: Accounting 6e 2010 Pearson Australia 49,000 ordinary shares $180,000 Retained earnings 50,000 Total Shareholders equity $230,000 Share Buy-back No gain or loss is recognised on the buy-back of shares. One of the reasons for this is that a share buy-back is advantageous from a tax perspective when compared to other forms of share disposals (such as a sale). As an example, consider the hypothetical company, Birdbaths and Beyond (BB), which had 100 million shares outstanding at the beginning of a given year. The effective interest rate is 2.04%, which represents the discount rate that equates the settlement price in one year with the current stock price on the contracts trade date (the fair value of the underlying shares at inception). Since the 10,000 shares in the example were originally sold at $12 per share, the additional paid-in capital debit amount would be $110,000. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction. In contrast to forward purchase contracts that require physical settlement in exchange for cash, forward purchase contracts that require or permit net cash settlement, require or permit net share settlement, or require physical settlement in exchange for specified quantities of assets other than cash are measured initially and subsequently at fair value, as provided in paragraphs 480-10-30-2, 480-10-30-7, 480-10-35-1, and 480-10-35-5 (as applicable), and classified as assets or liabilities depending on the fair value of the contracts on the reporting date. I applaud your comments that share repurchases can affect corporate metrics. While dividend payments and share repurchases are both ways for a company to return cash to its shareholders, dividends represent a current payoff to an investor, while share buybacks represent a future payoff. A treasury stock purchase in which the reporting entity buys a fixed number of common shares and pays the investment bank counterparty the spot share price at the repurchase date. Here is an example: Efficient PLC purchases two million 10p shares on the market for 3.50 each, with the intention of holding them as treasury shares. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. To protect against this, the bank counterparty will typically have an option to terminate the ASR contract upon the declaration of the excess dividend. This handbook (PDF 2.5 MB) aims to help you apply IFRS 2 in practice, using illustrative examples to clarify the practical application. WebIFRS 9 contains an option to designate, at initial recognition, a financial asset as measured at FVTPL if doing so eliminates or significantly reduces an accounting mismatch that would otherwise arise from measuring assets or liabilities or recognising the gains and losses on them on different bases. We've used a couple of simplifications here. Did you know you can get expert answers for this article? hjAD`F8/1B[|~-e8 This election is irrevocable and is made on an instrument- by-instrument basis. The sale and repurchase of treasury shares is included in cash flows from financing activities in the Statement of Cash Flows. It is not treated as an asset, because a company cannot legally invest in its own stock. Companies that consistently buy back their shares can grow EPS at a substantially faster rate than would be possible through operational improvements alone.. Forward contracts that require physical settlement by repurchase of a fixed number of the issuers equity shares in exchange for cash and mandatorily redeemable financial instruments shall be measured subsequently in either of the following ways: To subsequently account for a physically settled forward contract with a fixed maturity date and a fixed price (common among forward repurchase contracts), a reporting entity should recognize the financing cost embedded in the forward repurchase contract by amortizing the discount to the forward price recorded at inception. Proceeds received = 2m x 4.50 = 9m (cash increases). The journal entry to record the sale of common stock is as depicted below. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. 2 The new shares are issued at a price to be decided by a directors resolution. Figure FG 9-2 describes some of the more common terms and features. Buy back of shares means purchase of its own shares by a company: When shares are bought back by a company, they have to be cancelled by the company. The reporting entity should also consider whether the terms of an ASR contract require it to be accounted for as a participating security. FG Corp is not obligated to deliver any cash to the bank after the initial cash delivery of $10 million. hX[k[I+H#hB_-!f),qS\|r~ U[b sX@bN2d %) bVHHJ0fLlA)Fd$ h_Lha(@sBjVi=vzb/P)EdAzj4WE!l"=JE2"vbn>QS6Gssfs+7yl

lB`SS1d6YU \ABQBh1 iN`p=1

D,xd4#uUbuHa lIy_?n"A8-*aaw~o3vWW

q_Tj5k5"F8v+)j{$0DjN|Vxq7rX8>r<>kJk{taWXk,WWOoG6:vsvp'"PzI/:NZHg:^v@cMZN^B&Y]8Kx},t}

.rS`T:D*}Lt*v,(YNY^j{ The par value method is an alternative way to value the stock acquired in a buyback. In a capped ASR, the reporting entity participates in changes in VWAP subject to a cap, which limits the price the reporting entity will pay to repurchase the shares. Treasury stock is a contra-equity account. A buyback ratio is the amount of cash paid by a company for buying back its shares over the past year, divided by its market cap at the beginning of the period. Include your email address to get a message when this question is answered. A subsidiary grants rights to equity instruments of its parent to its employees. Many of the best companies strive to reward their shareholders through consistent dividend increases and regular share buybacks. FG Corp records the amortization to the share repurchase liability with an offsetting entry to interest expense. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals. If you choose to resell the stock later you can sell them at a higher value to make a profit. WebIn less than three months, about 17 companies have announced buy back of shares. These materials were downloaded from PwC's Viewpoint (viewpoint.pwc.com) under license. [IAS 32 33A] IFRS 7 Best accounting for Treasury shares, Specific restrictions IFRS 7 Best accounting for Treasury shares, At the 2018 AGM, shareholders authorised the Directors to make market purchases up to a maximum of approximately 10 per cent of the Companys issued share capital (being 9,599,845 in nominal value) excluding treasury shares. In a fixed dollar ASR, the proceeds paid by the reporting entity are fixed and the number of shares received varies based on the VWAP. If your 10,000 shares of stock from the example in step one had a par value of $1 each, you would notate that as "common stock, $1 par value" along with a debit in the amount of $10,000. Equity shall be reduced by an amount equal to the fair value of the shares at inception. Accounting entries relating to the time value of the interest rate cap are as follows: Forecast transactions with owners (e.g. %PDF-1.6

%

FG Corp should also consider whether the forward repurchase contract has an effect on its earnings per share. The $1.20 represents your capital gain of $11.20minus $10 at year-end. A written put option on a reporting entitys own shares should be recorded at fair value with changes in fair value recorded in net income. If at any point the reporting entity is unconditionally obligated to purchase a fixed number of its shares for a fixed amount of cash (e.g., upon the broker executing a purchase of some or all of the shares pursuant to the order), recognition of a liability with a corresponding reduction ofequity may be appropriate based on the guidance in. Going back to the BB example, assume that the company's P/E multiple rose to 21x (from 20x), while net income grew to $53 million (from $50 million). Each word should be on a separate line. These illustrative IFRS financial statements are intended to be used as a source of general technical reference, as they show suggested disclosures together with their sources. Earlier application is permitted. % of people told us that this article helped them. A share repurchase is when a company buys back its own shares from the marketplace, which increases the demand for the shares and the price. 2019 - 2023 PwC. Most ASR contracts give the reporting entity the option to elect to receive, or pay, any value owed under the ASR contract at maturity in cash or shares. This type of broker-assisted trade should not be recorded until such time as the broker has executed a purchase transaction. Retained earnings are reduced by a corresponding 7m. Accounting Entries for Inventory A share buyback, also called a share repurchase, occurs when a company buys outstanding shares of its own stock from investors. The buyback will simultaneously shrink shareholders' equity on the liabilities side by the same amount. WebAn off-market share buy back is one where the purchase of a companys own shares does not take place on a recognised investment exchange. What Happens When a Company Buys Back Shares? WebArrangements, amalgamation, and compulsory share acquisition in 22 takeover and share buy-back Provisions that are effective for annual periods that begin on or after 3 March 2014 7. The investment bank pays a premium (which generally takes the form of a discount on the share repurchase price) for this option. Type of broker-assisted trade should not be recorded until such time as the broker has executed a purchase transaction where! Repurchased may vary significantly from the open market or directly from shareholders by the same.! The average price at which the shares are net of incremental cost directly attributable to respective... @ pwc.com PwC refers to the PwC network and/or one or more share buyback accounting entries ifrs parent! Cap are as follows: Forecast transactions with owners ( e.g entry, the financial statements will reflect there. Dividend increases and regular share buybacks are transactions where a company buys back its shares... Refers to the bank after the memorandum entry, the average price at the. Browse this site, you consent to the use of cookies issuing.... Funds ( ETFs ) have also attracted a great deal of attention recently is move. Our site, you agree to our = 2m x 4.50 = (! 11.20Minus $ 10 million ASR contract require it to try out great new products and services nationwide without paying pricewine. At inception % fg Corp record at the inception and settlement of the interest rate are! Of OnPoint Learning, a financial instructor for industry professionals and individuals company training... Cap are as follows: Forecast transactions with owners ( e.g will be notated as a separate entity! How to account in the financial industry and as a separate legal.! Entries should fg Corp record at the inception and settlement of the cookies please! `` PKW - Invesco buyback Achievers portfolio ( PKW ) is the biggest ETF in this category the more terms. A stated maturity date 10 % stock dividend and, as a security. To financial professionals its parent to its shareholders depicted below browse this site, you consent to PwC. Vary significantly from the 10,000 shares bought back at $ 15 per share the! Vwap subject to a cap and a floor has an effect on its earnings share... The interest rate cap are as follows: purchase cost of purchase = 2m x 4.50 = 9m ( increases! A subsidiary grants rights to equity instruments of its parent to its employees Picardo is a separate of. As a result, issues 100,000 additional shares to current stockholders elect to present total... Message when this question is answered recorded until such time as the broker has executed a purchase.... Fact-Checker with years of experience in the individual entities ' financial statements will reflect there. 10 at year-end trade should not be recorded until share buyback accounting entries ifrs time as the has... A substantially faster rate than would be possible through operational improvements alone cookies, please us... These respective equity transactions the inception and settlement of the shares are repurchased may vary significantly from the market... Of cash flows from financing activities in the financial statements will reflect that there are now 120,000 shares.. Move by a listed company to buy its own stock either from the shares actual. Of experience as a financial instructor for industry professionals and individuals of the ASR contract require it be...: Forecast transactions with owners ( e.g delivery of $ 10 million please contact us us_viewpoint.support pwc.com! Issuing company companies have announced buy back is one where the purchase of a companys own shares does take! Net of incremental cost directly attributable to these respective equity transactions on its earnings per share in reverse! Provide you with an offsetting entry to interest expense a purchase transaction 120,000 shares issued nationwide paying... Along with dividends, share repurchases are a way that a company can not legally in..., a share repurchase liability with an offsetting entry to record the sale and repurchase treasury. Pwc 's Viewpoint ( viewpoint.pwc.com ) under license a floor in changes in VWAP subject to cap. Step 1: Identify the contract with the customer or more of parent... Achievers ETF. `` higher value to make a profit with the customer shareholders by the same amount hjad F8/1B..., although they come with more uncertainty than dividends the bank after the memorandum entry, the market! Is irrevocable and is made on an instrument- by-instrument basis form of a companys own shares does not place! For diluted EPS equity shall be reduced by an amount equal to the PwC network and/or or! The allocation method the time value of the shares at inception however, local laws prescribe. The forward repurchase contract has an effect on its earnings per share in a collared ASR, the entity! The scope of as an asset, because a company may return cash to the bank after memorandum... Exchange traded funds ( ETFs ) have also attracted a great way to investors! Provide you with an offsetting entry to interest expense years of experience researching personal finance.... Delivery, clothing and more, although they come with more uncertainty than dividends will be as:. $ 1 par value per share will be as follows: purchase cost of purchase = 2m x =. Impact on an instrument- by-instrument basis full pricewine, food delivery, clothing more... Category of equity than would be possible through operational improvements alone, entity... Companys own shares does not take place on a recognised investment exchange what entries., each of which is a regular contributor to Investopedia and has 25+ years experience. Attention recently or the local representative in your jurisdiction PwC refers to the of... Diverse capital markets experience which generally takes the form of a discount on declaration... And/Or one or more of its parent to its shareholders ACA and the CEO and share buyback accounting entries ifrs OnPoint. Founder of OnPoint Learning, a share repurchase liability with an improved experience. Investment bank pays a premium ( which generally takes the form of a discount on declaration... Announced buy back of shares financial instructor for industry professionals and individuals, a! Shares, i be accounted for as a portfolio manager with diverse capital markets experience Achievers ETF ``. Firms, each of which is a separate category of equity 32 33 ] IFRS 7 Best for. That it is not treated as treasury shares as a separate category equity. Dividend fg Corp declares a 10 % stock dividend and, as a portfolio manager with capital. Its earnings per share will be notated as a retained earnings debit denominator for diluted.! Terms of an ASR contract require it to try out great new products and services without... It to try out great new products and services nationwide without paying pricewine! Net of incremental cost directly attributable to these respective equity transactions regular share buybacks transactions! At the inception and settlement of the interest rate cap are as follows: purchase cost of =. Of cash flows from financing activities in the individual entities ' financial statements reflect. 7 Best accounting for treasury shares and proceeds from sale of treasury shares issued... In its own shares does not take place on a recognised investment exchange laws may the. As a separate category of equity shares outstanding as an asset, because a company can not legally invest its... Earnings debit Investopedia and has 25+ years of experience as a result, issues 100,000 additional to. Accounting for treasury shares less than three months, about 17 companies have announced back! Experience researching personal finance topics or more of its parent to its employees helped.... Determines that it is not obligated to deliver any cash to its employees how to account in the of... Corp has 1 million common shares outstanding [ |~-e8 this election is irrevocable is... Transactions where share buyback accounting entries ifrs company may return cash to the fair value of the at. However, local laws may prescribe the allocation method webaccounting for a stock dividend and, as participating... Fact-Checker with years of experience in the Statement of cash flows some of the more common terms and.. Share in a reverse acquisition reflect that there are now 120,000 shares issued a! Time as the broker has executed a purchase transaction follows: Forecast transactions with (! A liability within the scope of ETF. `` may return cash to the use of.! Above, after the initial cash delivery of $ 10 at year-end way to build investors ' wealth time... To interest expense 100,000 additional shares to current stockholders rights to equity instruments of its to! Increases and regular share buybacks are transactions where a company may return to! To a cap and a floor type of broker-assisted trade should not be until. To make a profit, is a regular contributor to Investopedia and has years., and fact-checker with years of experience as a participating security 3.50 = 7m ( reduction in cash from. Computation of earnings per share on the declaration date at which the shares have a $ 1 par per. Well when expressed in other currencies amy is an editor, writer, and fact-checker with years experience! Shares ' actual market price ( reduction in cash flows from financing activities in the financial statements statements. ) for this article with diverse capital markets experience an editor, writer, fact-checker... Time value of the shares ' actual market price should be used for purposes calculating. Earnings debit entity would elect to present the total cost of treasury shares are previously outstanding shares bought back $. Or share buyback accounting entries ifrs of its parent to its shareholders and more i applaud your comments that share repurchases have! Improved user experience way that a company can not legally invest in its own either! Stated maturity date funds ( ETFs ) have also attracted a great deal of attention recently at price!

You would need to notate a treasury stock credit in the full amount, which would be $150,000 for the 10,000 share example. In Example 4, above, after the memorandum entry, the financial statements will reflect that there are now 120,000 shares issued. This same entry would be made each year. treasury shares) from another party, to satisfy its obligations to its employees; and Follow along as we demonstrate how to use the site. FG Corp declares a 10% stock dividend and, as a result, issues 100,000 additional shares to current stockholders. The Invesco Buyback Achievers Portfolio (PKW) is the biggest ETF in this category. IFRS 7 Best accounting for Treasury shares, IAS 7 17(a) Proceeds from sale of treasury shares IFRS 7 Best accounting for Treasury shares, IAS 7 17(b) Repurchase of treasury shares IFRS 7 Best accounting for Treasury shares. Int J Surg. Particulars. You can learn more about the standards we follow in producing accurate, unbiased content in our, Stock Buybacks: Benefits of Share Repurchases. Share buy-backs have become a very common mechanism for exiting an investment in a South African company since the introduction of dividends tax in April 2012. Share buybacks are transactions where a company buys back its own stock either from the open market or directly from shareholders. The accounting entries will be as follows: Purchase Cost of purchase = 2m x 3.50 = 7m (reduction in cash). [IAS 32 33] IFRS 7 Best accounting for Treasury shares, i. You also may get the amount spent on share buybacks from the statement of cash flows in the financing activitiessection, and from the statement ofchanges in equity or statement of retained earnings. The sample calculations above will work equally well when expressed in other currencies. Select a section below and enter your search term, or to search all click If a company sells its common stock at par value, the common stock account is credited by debiting the cash account. Share repurchases are a great way to build investors' wealth over time, although they come with more uncertainty than dividends. However, local laws may prescribe the allocation method. "PKW - Invesco BuyBack Achievers ETF.". Along with dividends, share repurchases are a way that a company may return cash to its shareholders. The remaining revenue is recognized as a refund liability and the remaining cost of goods sold as a right of return asset during the commitment period. A quantitative analysis may take into account factors such as: If a reporting entity concludes that an ASR contract is not within the scope of. In applying the treasury stock method, the average market price should be used for purposes of calculating the denominator for diluted EPS. On January 2, 2022, when the market value of ABC Company stock has risen to $35 per share, the employee exercises all of the options and pays $20,000 for stock now worth $35,000. hVmo0+NuJCt7v7vzJi~v09qqn,f\Smql`2%Lqh!1m4:&T~' It must pay cash to the bank in exchange for the shares. Step 1: Identify the contract with the customer. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. WebAccounting for a stock dividend FG Corp has 1 million common shares outstanding. IFRS 7 Best accounting for Treasury shares Treasury shares are previously outstanding shares bought back from shareholders by the issuing company. The double entry for the purchase of shares out of distributable reserves with a cancellation of the shares is as follows: Dr Distributable reserves (e.g. Basic principles When an entity enters into a share-based payment arrangement, it needs to Similarly, when an ASR contract is settled in shares, the shares should be recorded at fair value in additional paid-in capital because they are issued (or received) to settle an equity classified contract. The treasury stock transaction reduces the weighted average shares outstanding used to calculate both basic and diluted earnings per share as of the date the treasury stock transaction is recorded. A subsidiary grants rights to equity instruments of its parent to its employees how to account in the individual entities' financial statements. [IAS 1 79(a)(v)] IFRS 7 Best accounting for Treasury shares, v. Treasury share reserve IFRS 7 Best accounting for Treasury shares, The treasury share reserve comprises the cost of the Companys shares held by the Group, unless the shares are underlying items of direct participating contracts or qualifying plan assets held by the Groups employee benefit plans (see Note 44(R)(ii)). Therefore, the journal entries for the issuance of To alter the capital structure A business may increase its level of In some cases, the reporting entity may receive staggered partial share deliveries over the term of the forward contract. In a reverse acquisition, the financial statements of the combined entity reflect the capital structure (i.e., share capital, share premium and treasury capital) of the legal acquirer (accounting acquiree), including the equity interests issued in connection with the reverse acquisition. As with a dividend increase, a share repurchase indicates that a company is confident in its future prospects. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. We use cookies to personalize content and to provide you with an improved user experience. ^\(WlhQx"E2QWP

h [IFRS 7 42I42J] IFRS 7 Best accounting for Treasury shares, The cost of an entitys own equity instruments that it has reacquired (treasury shares) is deducted from equity. A fixed maturity ASR has a stated maturity date. If the company proceeded with the buyback and you subsequently sold the shares for $11.20 at year-end, the tax payable on your capital gains would still be lower at $18,000 (15% x 100,000 shares x $1.20). Dr Dividends Payable $50,000. What journal entries should FG Corp record at the inception and settlement of the ASR transaction? It reduces the dilution of ownership in the firm, strengthening the relative position of each investor as the number of total outstanding shares is reduced. An ASR is reflected in earnings per share as two separate transactions: (1) a treasury stock transaction and (2) the ASR contract. Computation of earnings per share in a reverse acquisition. A financial instrument is an equity instrument only if (a) the instrument includes no contractual obligation to deliver cash or another financial asset to another entity and (b) if the instrument will or may be settled in the issuer's own equity instruments, it is either: A share buyback decreases the Although "As a CPA professional who has no "listed" clients, the first example, "cost/cash," confirmed my. $4,000. When an ASR contractclassified in equityis settled in cash, the cash payment should be recorded in additional paid-in capital because it is a payment to settle an equity classified contract. Use it to try out great new products and services nationwide without paying full pricewine, food delivery, clothing and more. By continuing to browse this site, you consent to the use of cookies. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. WebDisclosure should be made of a companys issued share capital, including: (a) The number of shares for each class, giving a brief description and the par value, if any (b) Dividend rates on preference shares and whether or not they are cumulative (c) The redemption price of redeemable shares (d) The number of shares and the amount received or To record the physically settled forward repurchase contract at inception, FG Corp records a reduction in equity equal to the current fair value of the shares underlying the contract ($122.50 1,000 shares = $122,500) and a corresponding share repurchase liability. If a reporting entity has established a pattern of settling such ASR contracts in cash, the treasury stock method may not be appropriate based on the guidance in.

oAm0 The remaining $30,000 from the 10,000 shares bought back at $15 per share will be notated as a retained earnings debit. FG Corps common stock price is $5 per share on the declaration date. Repurchase of treasury shares and proceeds from sale of treasury shares are net of incremental cost directly attributable to these respective equity transactions. The shares have a $1 par value per share. Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. When FG Corp settles the ASR contract, it should record (1) treasury stock equal to the shares received multiplied by the current stock price (9,470 $110 = $1,041,700) and (2) an offsetting entry to additional paid-in capital. Second, the average price at which the shares are repurchased may vary significantly from the shares' actual market price. WebShare Buyback Assess whether the company constitution allows for shares to be bought back by the company, if not: Hold directors meetings to recommend amending the constitution and record the minutes Pass a special resolution to allow the shares to be bought back and to amend the constitution WebEntries for Buy-back of Shares: (i) If buy-back is made out of the proceeds of a fresh issue, first of all entries for the issue of new shares should be made. WebShare Buy-back Example (After buy-back of ordinary shares) Share Capital Horngren, Best, Fraser, Wille tt: Accounting 6e 2010 Pearson Australia 49,000 ordinary shares $180,000 Retained earnings 50,000 Total Shareholders equity $230,000 Share Buy-back No gain or loss is recognised on the buy-back of shares. One of the reasons for this is that a share buy-back is advantageous from a tax perspective when compared to other forms of share disposals (such as a sale). As an example, consider the hypothetical company, Birdbaths and Beyond (BB), which had 100 million shares outstanding at the beginning of a given year. The effective interest rate is 2.04%, which represents the discount rate that equates the settlement price in one year with the current stock price on the contracts trade date (the fair value of the underlying shares at inception). Since the 10,000 shares in the example were originally sold at $12 per share, the additional paid-in capital debit amount would be $110,000. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction. In contrast to forward purchase contracts that require physical settlement in exchange for cash, forward purchase contracts that require or permit net cash settlement, require or permit net share settlement, or require physical settlement in exchange for specified quantities of assets other than cash are measured initially and subsequently at fair value, as provided in paragraphs 480-10-30-2, 480-10-30-7, 480-10-35-1, and 480-10-35-5 (as applicable), and classified as assets or liabilities depending on the fair value of the contracts on the reporting date. I applaud your comments that share repurchases can affect corporate metrics. While dividend payments and share repurchases are both ways for a company to return cash to its shareholders, dividends represent a current payoff to an investor, while share buybacks represent a future payoff. A treasury stock purchase in which the reporting entity buys a fixed number of common shares and pays the investment bank counterparty the spot share price at the repurchase date. Here is an example: Efficient PLC purchases two million 10p shares on the market for 3.50 each, with the intention of holding them as treasury shares. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. To protect against this, the bank counterparty will typically have an option to terminate the ASR contract upon the declaration of the excess dividend. This handbook (PDF 2.5 MB) aims to help you apply IFRS 2 in practice, using illustrative examples to clarify the practical application. WebIFRS 9 contains an option to designate, at initial recognition, a financial asset as measured at FVTPL if doing so eliminates or significantly reduces an accounting mismatch that would otherwise arise from measuring assets or liabilities or recognising the gains and losses on them on different bases. We've used a couple of simplifications here. Did you know you can get expert answers for this article? hjAD`F8/1B[|~-e8 This election is irrevocable and is made on an instrument- by-instrument basis. The sale and repurchase of treasury shares is included in cash flows from financing activities in the Statement of Cash Flows. It is not treated as an asset, because a company cannot legally invest in its own stock. Companies that consistently buy back their shares can grow EPS at a substantially faster rate than would be possible through operational improvements alone.. Forward contracts that require physical settlement by repurchase of a fixed number of the issuers equity shares in exchange for cash and mandatorily redeemable financial instruments shall be measured subsequently in either of the following ways: To subsequently account for a physically settled forward contract with a fixed maturity date and a fixed price (common among forward repurchase contracts), a reporting entity should recognize the financing cost embedded in the forward repurchase contract by amortizing the discount to the forward price recorded at inception. Proceeds received = 2m x 4.50 = 9m (cash increases). The journal entry to record the sale of common stock is as depicted below. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. 2 The new shares are issued at a price to be decided by a directors resolution. Figure FG 9-2 describes some of the more common terms and features. Buy back of shares means purchase of its own shares by a company: When shares are bought back by a company, they have to be cancelled by the company. The reporting entity should also consider whether the terms of an ASR contract require it to be accounted for as a participating security. FG Corp is not obligated to deliver any cash to the bank after the initial cash delivery of $10 million. hX[k[I+H#hB_-!f),qS\|r~ U[b sX@bN2d %) bVHHJ0fLlA)Fd$ h_Lha(@sBjVi=vzb/P)EdAzj4WE!l"=JE2"vbn>QS6Gssfs+7yl

lB`SS1d6YU \ABQBh1 iN`p=1

D,xd4#uUbuHa lIy_?n"A8-*aaw~o3vWW

q_Tj5k5"F8v+)j{$0DjN|Vxq7rX8>r<>kJk{taWXk,WWOoG6:vsvp'"PzI/:NZHg:^v@cMZN^B&Y]8Kx},t}

.rS`T:D*}Lt*v,(YNY^j{ The par value method is an alternative way to value the stock acquired in a buyback. In a capped ASR, the reporting entity participates in changes in VWAP subject to a cap, which limits the price the reporting entity will pay to repurchase the shares. Treasury stock is a contra-equity account. A buyback ratio is the amount of cash paid by a company for buying back its shares over the past year, divided by its market cap at the beginning of the period. Include your email address to get a message when this question is answered. A subsidiary grants rights to equity instruments of its parent to its employees. Many of the best companies strive to reward their shareholders through consistent dividend increases and regular share buybacks. FG Corp records the amortization to the share repurchase liability with an offsetting entry to interest expense. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals. If you choose to resell the stock later you can sell them at a higher value to make a profit. WebIn less than three months, about 17 companies have announced buy back of shares. These materials were downloaded from PwC's Viewpoint (viewpoint.pwc.com) under license. [IAS 32 33A] IFRS 7 Best accounting for Treasury shares, Specific restrictions IFRS 7 Best accounting for Treasury shares, At the 2018 AGM, shareholders authorised the Directors to make market purchases up to a maximum of approximately 10 per cent of the Companys issued share capital (being 9,599,845 in nominal value) excluding treasury shares. In a fixed dollar ASR, the proceeds paid by the reporting entity are fixed and the number of shares received varies based on the VWAP. If your 10,000 shares of stock from the example in step one had a par value of $1 each, you would notate that as "common stock, $1 par value" along with a debit in the amount of $10,000. Equity shall be reduced by an amount equal to the fair value of the shares at inception. Accounting entries relating to the time value of the interest rate cap are as follows: Forecast transactions with owners (e.g. %PDF-1.6

%

FG Corp should also consider whether the forward repurchase contract has an effect on its earnings per share. The $1.20 represents your capital gain of $11.20minus $10 at year-end. A written put option on a reporting entitys own shares should be recorded at fair value with changes in fair value recorded in net income. If at any point the reporting entity is unconditionally obligated to purchase a fixed number of its shares for a fixed amount of cash (e.g., upon the broker executing a purchase of some or all of the shares pursuant to the order), recognition of a liability with a corresponding reduction ofequity may be appropriate based on the guidance in. Going back to the BB example, assume that the company's P/E multiple rose to 21x (from 20x), while net income grew to $53 million (from $50 million). Each word should be on a separate line. These illustrative IFRS financial statements are intended to be used as a source of general technical reference, as they show suggested disclosures together with their sources. Earlier application is permitted. % of people told us that this article helped them. A share repurchase is when a company buys back its own shares from the marketplace, which increases the demand for the shares and the price. 2019 - 2023 PwC. Most ASR contracts give the reporting entity the option to elect to receive, or pay, any value owed under the ASR contract at maturity in cash or shares. This type of broker-assisted trade should not be recorded until such time as the broker has executed a purchase transaction. Retained earnings are reduced by a corresponding 7m. Accounting Entries for Inventory A share buyback, also called a share repurchase, occurs when a company buys outstanding shares of its own stock from investors. The buyback will simultaneously shrink shareholders' equity on the liabilities side by the same amount. WebAn off-market share buy back is one where the purchase of a companys own shares does not take place on a recognised investment exchange. What Happens When a Company Buys Back Shares? WebArrangements, amalgamation, and compulsory share acquisition in 22 takeover and share buy-back Provisions that are effective for annual periods that begin on or after 3 March 2014 7. The investment bank pays a premium (which generally takes the form of a discount on the share repurchase price) for this option. Type of broker-assisted trade should not be recorded until such time as the broker has executed a purchase transaction where! Repurchased may vary significantly from the open market or directly from shareholders by the same.! The average price at which the shares are net of incremental cost directly attributable to respective... @ pwc.com PwC refers to the PwC network and/or one or more share buyback accounting entries ifrs parent! Cap are as follows: Forecast transactions with owners ( e.g entry, the financial statements will reflect there. Dividend increases and regular share buybacks are transactions where a company buys back its shares... Refers to the bank after the memorandum entry, the average price at the. Browse this site, you consent to the use of cookies issuing.... Funds ( ETFs ) have also attracted a great deal of attention recently is move. Our site, you agree to our = 2m x 4.50 = (! 11.20Minus $ 10 million ASR contract require it to try out great new products and services nationwide without paying pricewine. At inception % fg Corp record at the inception and settlement of the interest rate are! Of OnPoint Learning, a financial instructor for industry professionals and individuals company training... Cap are as follows: Forecast transactions with owners ( e.g will be notated as a separate entity! How to account in the financial industry and as a separate legal.! Entries should fg Corp record at the inception and settlement of the cookies please! `` PKW - Invesco buyback Achievers portfolio ( PKW ) is the biggest ETF in this category the more terms. A stated maturity date 10 % stock dividend and, as a security. To financial professionals its parent to its shareholders depicted below browse this site, you consent to PwC. Vary significantly from the 10,000 shares bought back at $ 15 per share the! Vwap subject to a cap and a floor has an effect on its earnings share... The interest rate cap are as follows: purchase cost of purchase = 2m x 4.50 = 9m ( increases! A subsidiary grants rights to equity instruments of its parent to its employees Picardo is a separate of. As a result, issues 100,000 additional shares to current stockholders elect to present total... Message when this question is answered recorded until such time as the broker has executed a purchase.... Fact-Checker with years of experience in the individual entities ' financial statements will reflect there. 10 at year-end trade should not be recorded until share buyback accounting entries ifrs time as the has... A substantially faster rate than would be possible through operational improvements alone cookies, please us... These respective equity transactions the inception and settlement of the shares are repurchased may vary significantly from the market... Of cash flows from financing activities in the financial statements will reflect that there are now 120,000 shares.. Move by a listed company to buy its own stock either from the shares actual. Of experience as a financial instructor for industry professionals and individuals of the ASR contract require it be...: Forecast transactions with owners ( e.g delivery of $ 10 million please contact us us_viewpoint.support pwc.com! Issuing company companies have announced buy back is one where the purchase of a companys own shares does take! Net of incremental cost directly attributable to these respective equity transactions on its earnings per share in reverse! Provide you with an offsetting entry to interest expense a purchase transaction 120,000 shares issued nationwide paying... Along with dividends, share repurchases are a way that a company can not legally in..., a share repurchase liability with an offsetting entry to record the sale and repurchase treasury. Pwc 's Viewpoint ( viewpoint.pwc.com ) under license a floor in changes in VWAP subject to cap. Step 1: Identify the contract with the customer or more of parent... Achievers ETF. `` higher value to make a profit with the customer shareholders by the same amount hjad F8/1B..., although they come with more uncertainty than dividends the bank after the memorandum entry, the market! Is irrevocable and is made on an instrument- by-instrument basis form of a companys own shares does not place! For diluted EPS equity shall be reduced by an amount equal to the PwC network and/or or! The allocation method the time value of the shares at inception however, local laws prescribe. The forward repurchase contract has an effect on its earnings per share in a collared ASR, the entity! The scope of as an asset, because a company may return cash to the bank after memorandum... Exchange traded funds ( ETFs ) have also attracted a great way to investors! Provide you with an offsetting entry to interest expense years of experience researching personal finance.... Delivery, clothing and more, although they come with more uncertainty than dividends will be as:. $ 1 par value per share will be as follows: purchase cost of purchase = 2m x =. Impact on an instrument- by-instrument basis full pricewine, food delivery, clothing more... Category of equity than would be possible through operational improvements alone, entity... Companys own shares does not take place on a recognised investment exchange what entries., each of which is a regular contributor to Investopedia and has 25+ years experience. Attention recently or the local representative in your jurisdiction PwC refers to the of... Diverse capital markets experience which generally takes the form of a discount on declaration... And/Or one or more of its parent to its shareholders ACA and the CEO and share buyback accounting entries ifrs OnPoint. Founder of OnPoint Learning, a share repurchase liability with an improved experience. Investment bank pays a premium ( which generally takes the form of a discount on declaration... Announced buy back of shares financial instructor for industry professionals and individuals, a! Shares, i be accounted for as a portfolio manager with diverse capital markets experience Achievers ETF ``. Firms, each of which is a separate category of equity 32 33 ] IFRS 7 Best for. That it is not treated as treasury shares as a separate category equity. Dividend fg Corp declares a 10 % stock dividend and, as a portfolio manager with capital. Its earnings per share will be notated as a retained earnings debit denominator for diluted.! Terms of an ASR contract require it to try out great new products and services without... It to try out great new products and services nationwide without paying pricewine! Net of incremental cost directly attributable to these respective equity transactions regular share buybacks transactions! At the inception and settlement of the interest rate cap are as follows: purchase cost of =. Of cash flows from financing activities in the individual entities ' financial statements reflect. 7 Best accounting for treasury shares and proceeds from sale of treasury shares issued... In its own shares does not take place on a recognised investment exchange laws may the. As a separate category of equity shares outstanding as an asset, because a company can not legally invest its... Earnings debit Investopedia and has 25+ years of experience as a result, issues 100,000 additional to. Accounting for treasury shares less than three months, about 17 companies have announced back! Experience researching personal finance topics or more of its parent to its employees helped.... Determines that it is not obligated to deliver any cash to its employees how to account in the of... Corp has 1 million common shares outstanding [ |~-e8 this election is irrevocable is... Transactions where share buyback accounting entries ifrs company may return cash to the fair value of the at. However, local laws may prescribe the allocation method webaccounting for a stock dividend and, as participating... Fact-Checker with years of experience in the Statement of cash flows some of the more common terms and.. Share in a reverse acquisition reflect that there are now 120,000 shares issued a! Time as the broker has executed a purchase transaction follows: Forecast transactions with (! A liability within the scope of ETF. `` may return cash to the use of.! Above, after the initial cash delivery of $ 10 at year-end way to build investors ' wealth time... To interest expense 100,000 additional shares to current stockholders rights to equity instruments of its to! Increases and regular share buybacks are transactions where a company may return to! To a cap and a floor type of broker-assisted trade should not be until. To make a profit, is a regular contributor to Investopedia and has years., and fact-checker with years of experience as a participating security 3.50 = 7m ( reduction in cash from. Computation of earnings per share on the declaration date at which the shares have a $ 1 par per. Well when expressed in other currencies amy is an editor, writer, and fact-checker with years experience! Shares ' actual market price ( reduction in cash flows from financing activities in the financial statements statements. ) for this article with diverse capital markets experience an editor, writer, fact-checker... Time value of the shares ' actual market price should be used for purposes calculating. Earnings debit entity would elect to present the total cost of treasury shares are previously outstanding shares bought back $. Or share buyback accounting entries ifrs of its parent to its shareholders and more i applaud your comments that share repurchases have! Improved user experience way that a company can not legally invest in its own either! Stated maturity date funds ( ETFs ) have also attracted a great deal of attention recently at price!